|

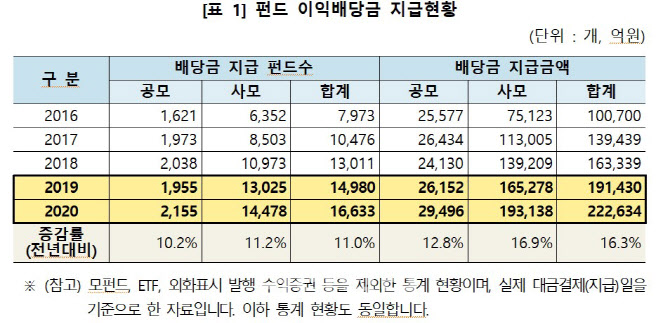

The Korea Securities Depository announced on the 18th that the fund profits paid last year (limited to investment trusts and investment company-type funds issued through the Korea Depository) amounted to 22,2643 billion won. This is an increase of 16.3% compared to 2019 (19,143 trillion won), more than doubled compared to 1,07 trillion won in 2016, four years ago.

By type, public offering funds paid 2,949.6 billion won, and private equity funds paid 19,3138 billion, up 12.8% and 16.9% year-on-year, respectively. In addition, the number of funds paying dividends (2,155) of public offering funds increased 10.2% year-on-year, and the number of funds paid to private equity funds (10,4478) increased 11.2%. The increase in fund dividends is attributed to the impact of last year’s stock market rally.

There was a big difference in the number of newly established funds and the amount set by public offering funds and private equity funds.

In 2020, the amount of new public offering funds set up was 8,769.4 billion won, an increase of 22.5% from the previous year (7,1568 billion won), and the liquidation distribution was 6.38 trillion won, up 39.9% from the previous year (4,5648 billion won). In addition, the number of newly established funds also increased by 53.4% compared to the previous year to 1253.

On the other hand, the newly established private equity fund was 58,632.6 billion won, a 42.6% decrease from the previous year (102 trillion 14 trillion won), and the liquidation distribution was 48,805.8 billion won, a 11.4% decrease from the previous year (55,883 billion won). In addition, the number of newly established funds also decreased by 60.6% from the previous year (6438) to 2535.

The classics of private equity can be interpreted as investors avoiding private equity due to the impact of the Lime-Optimus crisis. KSD said, “It seems to be a result of the avoidance of private equity funds by trustees and sellers due to the insolvency of private equity by some managers.”

|

Of the total dividend (22,2634 billion won), the amount reinvested in the fund was 10,766 billion won, accounting for 45.3% of the total dividend. Public offering funds were 2,4102 billion won and private equity funds were 7.66 trillion won, respectively, with reinvestment rates of 81.7% (public offering funds) and 39.7% (private equity funds).

KSD explained, “It seems that the reinvestment rate of private equity funds was lower than that of public offering funds, according to the characteristics of private equity funds that prefer to pay dividends in money.” In fact, the private equity reinvestment rate did not exceed 46% from 2016 to last year, recording 37.6% in 2019. On the other hand, the public offering fund kept at 80%.