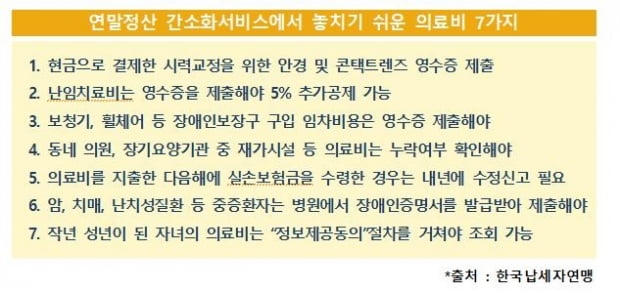

In this year’s year-end settlement simplification service, the cost of purchasing glasses for vision correction has been newly added, but if you purchase it in cash, it cannot be viewed, so you must obtain a receipt directly from the place of purchase and submit it to the company.

For medical expenses spent last year, if you received indemnity insurance in January of this year, you need to make a revised report during the next year’s comprehensive income tax filing period, as the indemnity insurance will be searched in the next year’s simplified service.

On the 18th, the Korea Taxpayers Association introduced these contents and ‘7 medical expenses that are easy to miss in the year-end settlement simplified service’.

▲ Submitting a receipt for glasses and lenses paid in cash = Glasses and contact lenses for vision correction paid by card from this year will be inquired through the year-end settlement simplified service.

However, purchases made in cash are not searched, so you must obtain a separate receipt from the place of purchase and submit it to the company.

Eyeglasses for vision correction can be recognized as medical expenses up to 500,000 won per family member.

▲ 5% additional deduction for infertility treatment fee is possible only upon receipt of receipt = Medical expense tax deduction is tax deductible for 15% of expenditure exceeding 3% of annual salary, but 20% tax deduction for fertility treatment expenses.

Since it is provided without distinction in the medical expenses category of the year-end settlement simplified service, the 20% tax credit can be applied only if a worker receives a medical expense payment confirmation from a hospital and a pharmacy and writes it separately.

If it is difficult to submit a receipt for privacy protection, it can be additionally returned through a correction request after March 11th.

▲ You must pay a receipt for rental expenses for purchasing hearing aids, wheelchairs, etc. = The rental fees for purchasing hearing aids and wheelchairs, etc., are not required to be submitted by law, so they are not viewed in the year-end settlement simplified service.

Therefore, an individual must receive a receipt and submit it to the company.

▲ Check for omission of medical expenses, such as local clinics = Home facilities among local clinics and long-term care institutions are small, so data may not be submitted or delayed, so check for omissions.

If the data is not searched by the year-end settlement simplification service, a separate receipt must be issued from the relevant institution and submitted to the company.

▲ Medical Expenses If you receive indemnity insurance payments the following year, you must file a revised report next year = 1 million won was spent in 2020 for medical expenses, and if you received 800,000 won in January 2021, you will be eligible for the year-end settlement simplified service next year instead of this year. Since the actual loss insurance is inquired, it is necessary to file a revised return for the amount deducted this year until the comprehensive income tax return in May next year.

▲ A certificate of disability must be obtained from a hospital for severely ill patients such as cancer and dementia. = Under the tax law, the disabled person is a broader concept than the concept under the Disability Welfare Act.

If your parents and siblings are severely ill such as cancer, stroke, chronic renal failure, leukemia or other intractable diseases, you must obtain a certificate of disability from the hospital and submit it to the company to deduct additional deductions for the disabled and medical expenses.

Basic deductions are possible even if they are under the age of 60 if parents living separately or siblings living with resident registration are disabled.

▲ Medical expenses of children who became adult last year can only be inquired through the’information agreement’ procedure = For those born before December 31, 2001, when they became adult last year, they must go through the’information consent’ procedure in the year-end settlement simplification. In the year-end settlement simplified service, the details of the child’s expenses are verified.

/yunhap news