Enter 2021-03-18 22:31 | Revision 2021-03-18 22:35

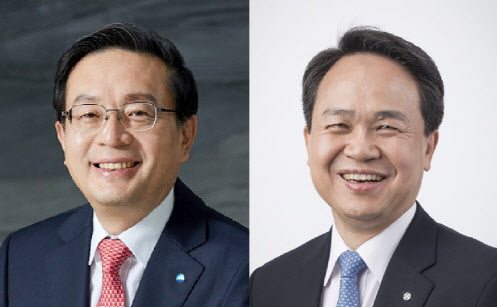

▲ Son Tae-seung, chairman of Woori Finance (left) and Jin Ok-dong, president of Shinhan Bank ⓒ Each company

The Financial Supervisory Service’s Sanctions Deliberation Committee discussed the level of disciplinary action against Lime Fund sales companies Woori Bank and Shinhan Bank at 2 p.m. on the 18th. Shinhan Bank Chairman Jin Ok-dong was present, but Woori Finance Chairman Son Tae-seung did not.

The sanctions review committee reviewed until late at night while listening to the statements and explanations of the bank officials (including legal representatives) and the prosecutors’ office sufficiently, but due to time, the meeting was terminated, and the meeting decided to resume later.

Earlier, the Financial Supervisory Service held a sanctions review against these banks on the 25th of last month, but as the deliberation process for Woori Bank lengthened, it could not draw any conclusions.

The issue of this sanction review by Woori Bank is whether or not the Lime Fund is insolvent in advance and the bank’s unfair solicitation.

Shinhan Bank is a confrontational point between the Financial Supervisory Service and the bank whether it is possible to punish the CEO for poor internal control.

Earlier, the Financial Supervisory Service (FSS) informed Woori Financial Group Chairman Son Tae-seung, who was the head of Woori Bank at the time of the sale of the Lime Fund, a “job suspension” (a significant amount), and Jin Ok-dong, the head of Shinhan Bank, of the severe disciplinary action of the “Response Warning”. Shinhan Finance Chairman Cho Yong-byeong was notified of a cautionary warning.

If Chairman Son Tae-seung is suspended from office as originally planned, three consecutive terms are impossible. Shinhan Bank President Jin Ok-dong, who was notified of a censure warning in advance, also puts a brake on his three consecutive appointments as president and the challenge of Shinhan Finance Chairman.

The biggest concern for this sanctions review is whether the disciplinary levels of Woori Financial Group Chairman Son Tae-seung and Shinhan Bank President Jin Ok-dong will be reduced.

The Financial Supervisory Service held responsible for the two banks on the grounds that the two banks were responsible for the incomplete sale of Lime Funds, and the lack of’internal control’, such as the laws and enforcement ordinances related to the governance structure of financial companies. On the other hand, banks reportedly confronted that lack of internal control was not a direct basis for imposing sanctions on management.

Woori Bank’s Lime Fund sales amounted to 357.7 billion won, and Shinhan Bank sold 2769 billion won.

It is also of interest that banks’ efforts to protect consumers will lead to lower sanctions by CEOs.

In the last sanctions review, the Financial Supervisory Service (Financial Consumer Protection Office) appeared as a reference to express opinions on Woori Bank consumer protection measures and damage relief efforts. The opinions presented by the complainant may influence the level of disciplinary action.

Woori Bank accepted the dispute settlement proposal to return the full amount of the principal to the victims of the trade finance fund and the dispute settlement proposal of the fund with unconfirmed losses.

The agency did not attend the Shinhan Bank sanctions review. Shinhan Bank plans to go through the dispute settlement procedure of Lime Fund, whose losses have not been confirmed.

The Financial Supervisory Service determined that Shinhan Financial Group was responsible for managing the complex store operation in the process of selling lime funds at Shinhan Bank and Shinhan Financial Investors complex stores.

Press releases and article reports [email protected]

[자유민주·시장경제의 파수꾼 – 뉴데일리 newdaily.co.kr]

Copyrights ⓒ 2005 New Daily News-Unauthorized reproduction, redistribution prohibited

recommendation

Related Articles It’s good to read it with the article you just saw!

Vivid

Headline news Meet the main news at this time.