Will the’ant’ potential be seen even in bitcoin investment… JPMorgan “Individuals, institutions and investment scale boil”

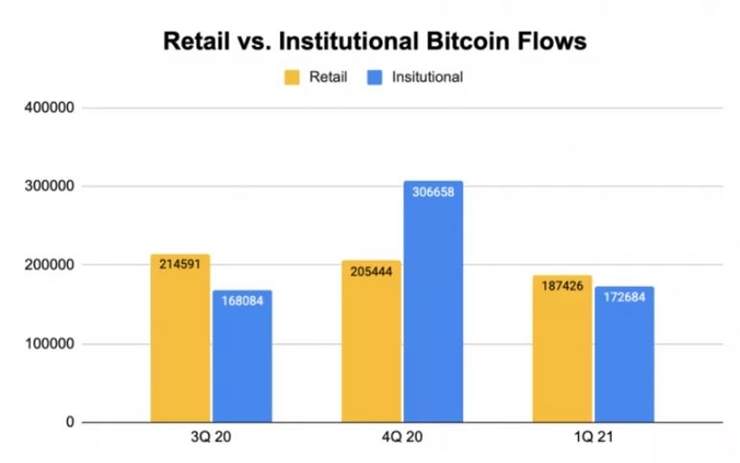

As institutional investment activity, which led the market in the fourth quarter of 2020, has slowed, the size of individual and institutional bitcoin investment in the first quarter of 2021 is showing a similar level. Individual investment activities with economic stimulus funds in hand are expected to survive further.

According to Bloomberg on March 15, 2021 (local time), JPMorgan analyst Nikolaos Panigirtzoglou said in a report, “Institutions led bitcoin investments in the fourth quarter of 2020. This quarter, individuals and institutions have led the way. The proportion is balanced and it is reproducing the appearance of the third quarter of 2020,” he diagnosed.

JPMorgan analyzes individual bitcoin investment flow through Square and ItBit (PayPal bitcoin supplier) data, which provides services for individual investors, and The investment flow of the institution was confirmed through the notification of the purchase of bitcoin.

Individual investors have bought 187,000 BTC to date in the first quarter, outpacing institutions that have bought 173,000 BTC. The size of the institution’s Bitcoin investment has declined significantly from 36,658 BTC in the fourth quarter of 2020.

Bitcoin purchases supported by Square have roughly doubled from $1.76 billion in the fourth quarter of 2020 to $3.36 billion in the first quarter of 2021. Itbit’s trading volume also increased from $2,173 million in the fourth quarter of 2020 to $4.15700.

In the same period, the amount of bitcoin fund inflows from the institutional sector declined from $3.97 billion to $2.9 billion. CME Bitcoin futures increased from $1.284 billion to $1,489 billion, and announcements to buy bitcoin by companies increased from $990 million to $3.17 billion.

Personal Bitcoin investments have risen significantly from $3.92 billion in the fourth quarter of 2020 to $7.518 billion in the first quarter of 2021. The institution had a steady flow of inflows from $6.24 billion to $7.519 billion.

Meet the main articles of TokenPost through the newsletter (Subscribe)

The increase in institutional investment participation at the end of 2020 is considered to be the main reason for driving the bull market of bitcoin along with the entry of large banks and asset managers into the cryptocurrency market.

Amid slowing institutional inflows, individual investors who received $1400 stimulus funds are expected to expand their influence in the bitcoin investment market.

JPMorgan analyst predicted that “individuals will surpass the institutional level in the total bitcoin investment in the first quarter of this year.” As the US economic stimulus plan is finalized, it is predicted that the scale of individual investors’ bitcoin investment will further expand.

“Bitcoin trading was very important to individual investors in a pandemic situation,” said Ed Moya, Senior Market Analyst Ohanda. I left it,” he explained. Bitcoin has soared 990% over the past year.

Moya also believes that the NFT fever and stimulus funds will energize personal investment activities.

US President Joe Biden passed the $1.9 trillion economic stimulus law on March 11. Since then, on March 14, Bitcoin reached a record high of $61788.

According to Token Post Market, as of 4:40 p.m. on March 16, Bitcoin is trading at $55,000, down 5.08%. The industry is diagnosing that there was not enough institutional inflow to maintain the $60,000 level.

Token Post | [email protected]

<저작권자 © TokenPost, 무단전재 및 재배포 금지 >