[플러스 PICK] Time.

Reporter Jihyo Lee, the first keyword is’What is the short selling price?’

What is Short Selling Really?

Short selling can literally be viewed as’selling missing stocks’.

If the stock price is likely to fall, first borrow the stock from a brokerage company and sell it.

If the stock price falls, then it is a method of buying and paying off.

For example, if you borrow and sell 10 shares of a 100 won stock of a company, you get 1,000 won.

If this stock falls in half, then you can buy 10 shares for 500 won.

At this time, if I repay what I borrowed from a brokerage company, I have 500 won left.

Short selling is a trading technique that bets on a decline in stock prices and is actively engaged overseas.

So how about our country?

It is currently banned in Korea.

As stock prices plummeted in March last year, the government banned short selling of all stocks for six months.

When short selling powers betting on falling stock prices increase

It was extended once more because of concerns that individual investors will lose money.

The problem is that short selling will resume on March 16th.

Because of this, the market is not hot right now, and there was a lot of opposition.

Yes. As you can see, “I petition for a permanent ban on short selling”

The Blue House national petition has also been posted, and more than 100,000 people have agreed.

The reason why individual investors are rebelling is the recent stock market is good.

This is because of concerns that if short selling is released, it could stagnate again.

Even in the politics, a battle over short selling began, right?

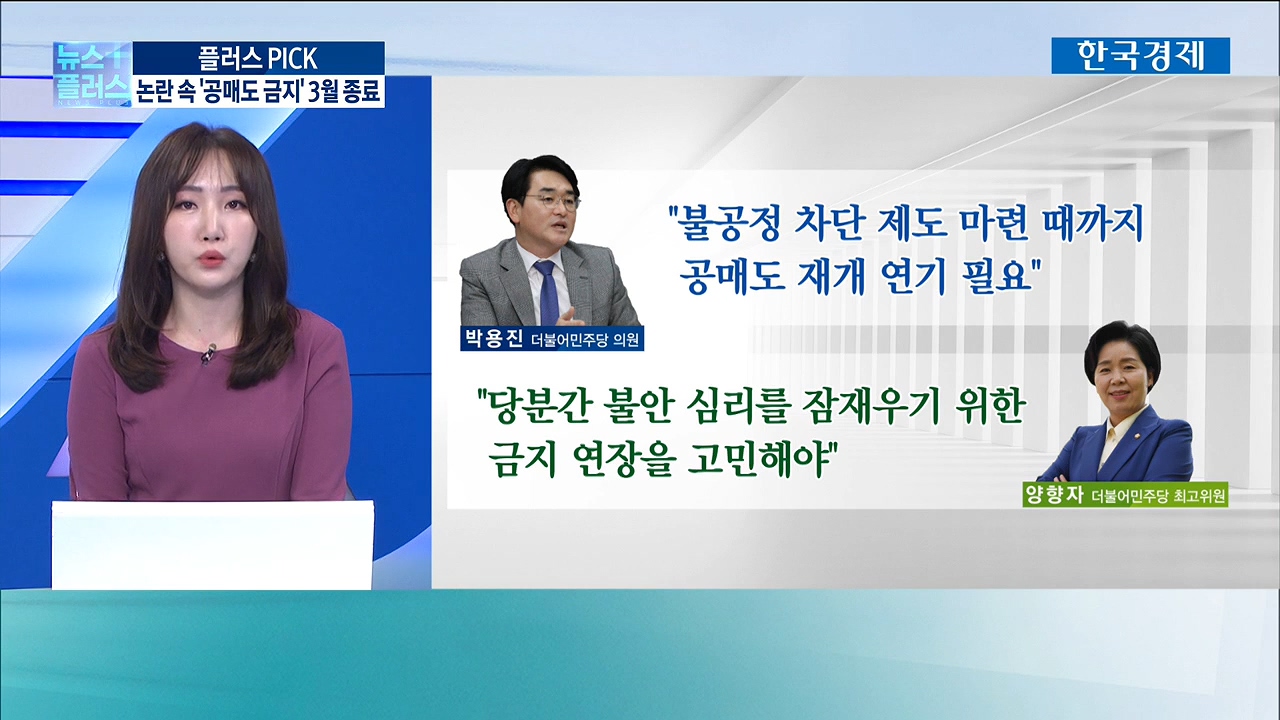

Yes. In addition, within the Democratic Party, Rep. Park Yong-jin and Yang Hyang-ja,

We are taking the lead in demanding a renewal of the ban on short selling.

Rep. Park Yong-jin said, “There is no system to block market unfair behavior by foreigners and institutions.

“The resumption of short selling should be postponed until it is prepared.”

Regardless of the state of the stock market, there are many holes in the current short selling system.

Chief Commissioner Yang Hyang-ja also said, “For the time being, we will calm the anxiety about braking.

“We need to ensure that the heated capital market can lead to the real thing.”

In addition, he added, “I have to give an answer this month and give me time to prepare for the market.”

In the past, hasn’t the short selling rate been extended as such remarks came out in the political world?

I’m curious what will happen in the future.

Yes, it is.

The Financial Services Commission nailed it as “the first text message sent is the official position.”

The system will be improved and short selling will resume in March as scheduled.

Looking at what the Financial Services Commission is currently working on,

It opens the way for individuals to sell short like foreigners and institutions,

The key is to clearly regulate the illegal part of short selling.

Public opinion is that they don’t want to sell short,

The government is selling short, but it is going to open a way for individuals.

The government and industry also have their own reasons.

First of all, short selling acts like a safeguard.

If there is a bubble in the stock price and it rises too much, short selling comes in and suppresses it.

When the stock price falls, the short selling force becomes the buying force

It prevents excessive falling.

It’s preventing excessive volatility.

Yes, and most of the world allows short selling.

Prohibiting only us could affect the external credibility of our stock market.

In a situation where our market is heavily influenced by foreigners,

It is an opinion that banning short selling may make it less attractive.

Haven’t the government recommended stock investment while emphasizing the KOSPI 3,000 era?

If short selling is resumed, it would be against the government’s policy to increase liquidity.

Yes, so it seems that the government is in a situation that neither does this nor does it.

Although short selling has a net function,

We cannot ignore public opinion that there are side effects that incite the market decline.

In addition, it is necessary to prevent the people’s sentiment from leaving ahead of the re-election in April.

There is an analysis that there is a possibility to change the route.

Rather than being swayed by public opinion, how much short selling encouraged the market decline,

If we resume short selling, we hope to objectively verify whether there is really no damage.