![[김현석의 월스트리트나우] Why the stocks of electric vehicles, solar power, and batteries plummeted](https://i0.wp.com/img.hankyung.com/photo/202102/01.25416890.1.jpg?w=560&ssl=1)

On the 18th (local time), the New York stock market was calm until it opened. Than economic events

The atmosphere was focused on the hearing on’Game Stop’ that will be held in the U.S. House of Representatives at 12 pm this day. The 10-year U.S. Treasury bond yield, which had shaken the market for several days with a soaring, remained in the high 1.2% range, and major index futures were also in weak bonds.

However, at 8:30 am, the number of claims for unemployment benefits the previous week was 861,000, far exceeding the market estimate (77 million people). It was the highest number since the week of January 16th. The previous week’s announcement of 793,000 was also raised by 55,000 to 848,000.

![[김현석의 월스트리트나우] Why the stocks of electric vehicles, solar power, and batteries plummeted](https://i0.wp.com/img.hankyung.com/photo/202102/01.25416893.1.jpg?w=560&ssl=1)

In particular, in the pandemic special unemployment benefit, the number of new claimants reached 516,000, an increase of 174,000 from the previous week. In other words, in the past week, a total of 1.38 million people applied for new unemployment benefits.

The 10-year Treasury bond rate soared to 1.316% in an instant. As it has been confirmed that the recovery of the job market is still difficult, expectations for more stimulus measures have increased. Greater stimulus means more government bond issuance and fiscal spending, and the central bank’s (Fed) continued liquidity supply. They are all factors that increase interest rates.

A Wall Street official said, “If the original economic indicators are not good, it is normal for interest rates to go down, but now the economy and the market as a whole are hung up on monetary and fiscal policy.” I explained.

Also, import prices for January rose 1.4% compared to the previous month, much higher than expected (1.0% increase). This is the highest increase in 9 years since March 2012.

Corporate performance was also disappointing. The stock price plummeted by more than 4% from the pre-opening transaction as Wal-Mart announced its sluggish 4Q net profit and presented a somewhat negative outlook for this year’s earnings.

At 9:30 a.m., when the regular market opened, the leading indexes started lower. The Nasdaq started the market with a drop of more than 1%.

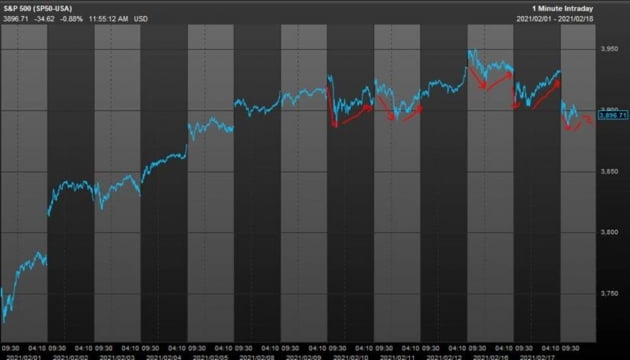

However, as time went on, the buying trend began to flow in and out of the S&P 500’s 3900 line again and again. This pattern has occurred on 5 trading days over the last 6 trading days. The New York stock market started on a downtrend and rebounded as the low-priced buying trend came in. CNBC’s Mike Santoli, a stock analyst, said, “This rebound shows the elasticity of the stock market, but it also shows that investors are getting tired.”

![[김현석의 월스트리트나우] Why the stocks of electric vehicles, solar power, and batteries plummeted](https://i0.wp.com/img.hankyung.com/photo/202102/01.25416900.1.jpg?w=560&ssl=1)

In the end, the Dow fell 0.38%, the S&P 500 closed 0.44% and the Nasdaq fell 0.72%.

The reason that the NASDAQ declined again is that high-growth technology stocks did not rebound even in the second half of the market. Fuel cell (-16.55) plug power (-10.67%) Bloom energy (-7.48%) Nikola (-6.26%) Nio (-5.04%) Sunpower (-) As profit-taking sales continue to flow out, perhaps because of anxiety about rising interest rates. 16.69%) The decline of highly valued technology stocks, which have soared so far, such as electric vehicles, batteries, and solar power such as First Solar (-4.65%), has been considerably large. Chinese technology stocks, including Baidu (-3.46%), Alibaba (-2.47%), Tencent (-1.32%), and Pindudo (-3.47%), also plunged.

![[김현석의 월스트리트나우] Why the stocks of electric vehicles, solar power, and batteries plummeted](https://i0.wp.com/img.hankyung.com/photo/202102/01.25416898.1.jpg?w=560&ssl=1)

The 10-year yield also fell slightly to the high 1.2% range. A Wall Street official said, “It can be seen that there is still pressure to increase interest rates if the interest rate remains at this level despite the number of claims for unemployment benefits that have increased rapidly.”

![[김현석의 월스트리트나우] Why the stocks of electric vehicles, solar power, and batteries plummeted](https://i0.wp.com/img.hankyung.com/photo/202102/01.25416972.1.jpg?w=560&ssl=1)

“Early this month, a Democratic Party member Larry Summers warned that’too large a stimulus could lead to overheating,’ and the market mood changed.” “The number of points raised is gradually increasing.”

But the Biden administration has no signs of withdrawing. Finance Minister Janet Yellen also appeared on CNBC that day and said, “We need a stimulus for a’big package’ that will help the economy achieve a full recovery,” and “I think the cost of spending too little is much higher than doing it big.” . “I’m not worried that all government spending will lead to inflation in the future.”

![[김현석의 월스트리트나우] Why the stocks of electric vehicles, solar power, and batteries plummeted](https://i0.wp.com/img.hankyung.com/photo/202102/01.25416894.1.jpg?w=560&ssl=1)

This situation raises three questions: Investors are concerned about the possibility of a bigger stimulus → economic overheating and possible inflation → rising interest rates → stock market valuation threats.

![[김현석의 월스트리트나우] Why the stocks of electric vehicles, solar power, and batteries plummeted](https://i0.wp.com/img.hankyung.com/photo/202102/01.25416891.1.jpg?w=560&ssl=1)

How does Wall Street look? I’ll give you Wall Street’s consensus by quoting a recent report by JP Morgan (Big government, runaway inflation and a market bubble?).

① If more stimulus measures come out, would it be overheating in the face of economic resumption?

= Some economists, such as Larry Summers, claim that the stimulus package is too large.

But I think we are far from overheating. Most importantly, there is a huge slump in the job market. The employment-to-population ratio is the lowest since the early 1980s.

Did you see the January inflation figures released this week? The core consumer price index (CPI) rose 1.4% in January compared to the previous year. It is much lower than the Fed’s goal (2%). There are no signs of inflation anywhere.

According to the Congressional Budget Office (CBO) estimates, the US economy has grown below two-thirds of its potential growth since 1960. Now is the time to try to get the economy hotter.

![[김현석의 월스트리트나우] Why the stocks of electric vehicles, solar power, and batteries plummeted](https://i0.wp.com/img.hankyung.com/photo/202102/01.25416896.1.jpg?w=560&ssl=1)

② Still, there are great concerns about inflation. Will inflation soar due to the stimulus?

= Inflation will rise. That’s the point. Increasing inflation is likely to mean economic healing. It means that more Americans make more money and spend more, and they need more. In this case, the company raises commodity prices to maintain margins.

But don’t think inflation will skyrocket overnight. Consider the two most important factors of periodic inflation: wages and housing costs.

There is still a lot of room in the labor market, which means that there will be no pressure on wages for the time being. The same goes for housing costs. Home purchase prices rose, but rents fell during the epidemic. Only 9% of core personal spending is the only sector where spending can surge until the economy normalizes.

We expect inflation to increase gradually, giving enough time to adjust monetary policy.

![[김현석의 월스트리트나우] Why the stocks of electric vehicles, solar power, and batteries plummeted](https://i0.wp.com/img.hankyung.com/photo/202102/01.25416895.1.jpg?w=560&ssl=1)

③ Will inflation expectations and rising interest rates put pressure on the stock market?

=First, we think the stock market is well worth the valuation now.

First of all, the profitability of large-cap US companies has survived the sharpest economic downturn ever, but has survived. In addition, stocks and their long-term potential value are shining even more due to low bond rates. In addition, companies’ balance sheets are sound and the risk of bankruptcy is low. The Fed’s support for the investment grade corporate bond market played a major role.

Second, higher valuations are not the only way stocks can be valued. Earnings from stocks come from three sources: dividends, earnings growth, and a rise in the price-to-earnings ratio.

The dividend of the S&P 500 is 1.5% (the MSCI World Index is 1.9%). Surpass bond yields. In addition, profits of the S&P 500 are expected to grow by more than 25% this year. The price-to-earnings ratio, of course, could shrink slightly if interest rates rise, but it won’t be able to offset the sharp rise in earnings.

JP Morgan concludes this report. “The phase where we were hoping for an economic recovery will probably end soon. That means the phase of real growth is beginning. Do you want to miss that opportunity?”

The PS GameStop hearing was also a hearing. It was a lot of attention and noisy, but nothing was actually revealed.

Reporter Kim Hyun-seok [email protected]