Input 2021.03.13 06:00

The top 25 companies receive 80% of the quantity… “Quite unusual”

“It seems that investors with high understanding of Coupang’s business model have been selected”

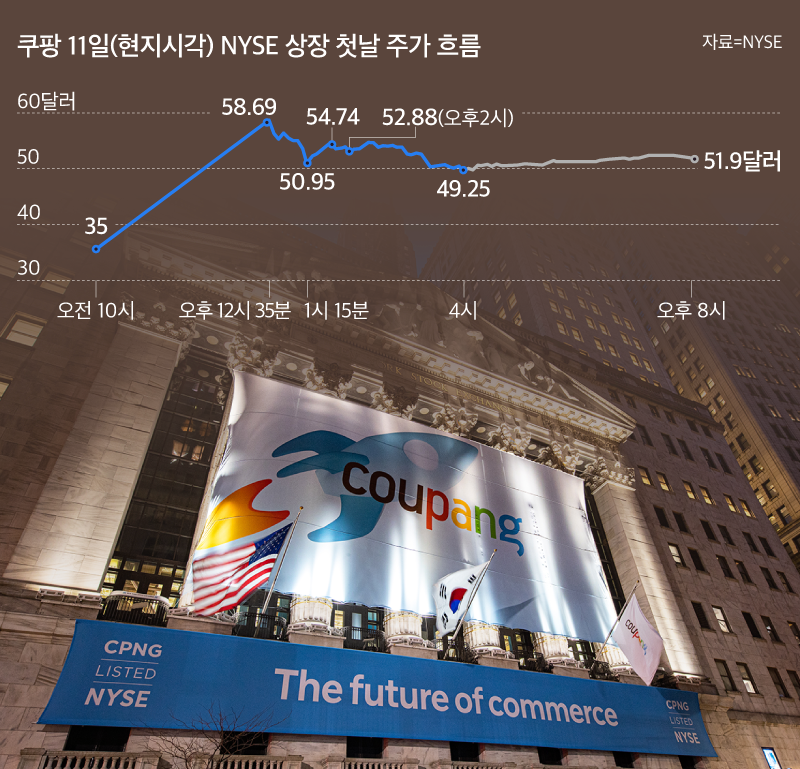

On the 11th (local time), Coupang made a successful debut with a market cap of close to 100 trillion won in the US stock market. However, attention is drawn to the background as it is known that there are fewer than 100 institutional investors who have received public offerings. It is analyzed that domestic stock markets may have selected institutional investors with a high understanding of the Korean e-commerce market in order to preemptively prevent the stock price fluctuations after Coupang’s listing.

Bloomberg cited an official familiar with the matter and said that Coupang allocated 80% of the public offering to 25 institutional investors. It was also said that the ratio of public offerings to specific investors was higher than that of other IPOs.

There are two main reasons why the number of investors who received public offerings from IPOs is usually small. In this case, the demand is low, or the IPO organizer is pushing the stock to an investor who is likely to hold the stock for a long time. Coupang is the case of the latter. This is because many institutional investors have placed orders to buy public offerings, but have not received one week. Some of the public offerings went to existing investors, according to Bloomberg.

An official in a domestic securities industry said, “Isn’t it that you want to keep taking a few institutional investors who can understand Coupang’s special business model as major shareholders.”

It is difficult for US investors to fully understand Coupang’s business model, given the lack of information about the country of Korea. In 2014, Alibaba in China was also an unfamiliar company to US investors, but it was making a surplus and was a solid number one business operator, unlike Korea, where competition is fierce.

Another stock industry official said, “Unlike Korea, in the US, public offering stocks are not allocated to individuals, so institutional investors play an important role in shaping the market at the beginning of listing.” It can also be interpreted as meaning that there were few US institutional investors with a good understanding of the Korean distribution industry.” In an interview with the US economic media CNBC, Chairman of the Board of Directors Kim Bum-seok emphasized that he would focus on the Korean market rather than the overseas market.

Coupang’s move to select investors in public offerings is also interpreted as a sign that the company is concerned about the ups and downs of the stock price after listing. Considering that Coupang’s reputation in the global market is not high, some investors are more likely to pay attention to the fact that the Vision Fund and Black Rock, chairman of SoftBank Chairman Son Jeong-eui, are the main shareholders rather than understanding the business model.

Professor Shin-seop Shin of the National University of Singapore told Nihon Gayizai (Nikkei) Asia, “Coupang is a case where major global shareholders compensated for the company’s shortcomings.”