Input 2021.01.29 06:00

Although the companies didn’t come up with a win-win relationship…

The convenience store industry has entered a battle to capture more than 4,000 stores appearing in the free contract (FA) market this year.

According to the Korea Convenience Store Industry Association on the 29th, the number of domestic convenience stores increased from 1161 in 2014 to 2974 in 2015 and 3617 in 2016. Considering the usual five-year contract period, the contracts of 4,000 stores are expected to expire this year.

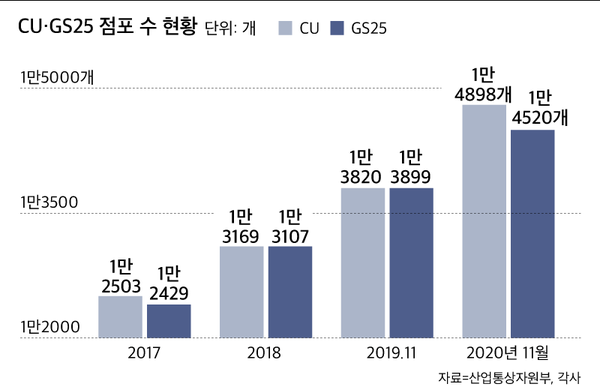

Convenience stores that have become difficult to open new stores are expected to compete fiercely to take away other store owners. In particular, top-tier companies such as CU and GS25 are attracting attention.

Convenience store companies say that it is important to increase sales per store rather than expanding the number of stores, as profits have decreased due to the coronavirus infection (Corona 19). An official at a convenience store said, “As we have achieved some degree of’economy of scale,’ we are focusing on qualitative growth rather than recklessly expanding stores.”

However, the industry analyzes that as consumers refrain from outside activities and sales per store have fallen, they have no choice but to pursue quantitative growth through new stores. Last year, BGF Retail (282330)Silver’s operating profit fell 1.7% in the third quarter of last year, and is estimated to have decreased by double digits annually. GS Retail (007070)Also, operating profit at the convenience store division fell 9.8% in 3Q.

Companies have come up with various win-win plans to secure new stores. CU suggested reduction and exemption of penalty fees and strengthening requirements for changing business areas. Refrigeration and refrigeration compensation insurance and product liability insurance are subscribed to stores nationwide, and the entire insurance premium is borne by the affiliate headquarters.

GS25 provides support for 50% of electricity bills for affiliated stores and a subsidy for night sales activation (up to 500,000 won). This year, it plans to reinforce the delivery service by paying condolence money for natural disasters to affiliates. Seven-Eleven (10,486 stores), the third largest operator, plans to improve the system to enable all store management tasks at the POS at the counter, and to increase the efficiency of store operation by introducing a personal portable information terminal (PDA). to be.

Store owners who are about to renew their contract this year are struggling. Usually, when a franchisee is renewed, a contract is signed with the head office based on the sales of the last one year, because last year’s sales were sluggish and the possibility of signing a contract on good terms is low.

Convenience stores located in offices and entertainment districts are often closed due to falling sales. The president of a convenience store in Jongno, Seoul, said, “Since January last year, sales fell by more than half, resulting in a loss throughout the year,” and said, “I decided to close the business because I could not afford 20 million won per month.”

Kye Sang-hyuk, chairman of the convenience store franchisees’ council, said, “Store owners who are about to renew their contract this year are in very unfavorable conditions. Although companies have come up with a win-win plan, most of them are less attractive because of system improvements to improve business efficiency. It is a reality that is increasing.