Input 2021.03.25 14:10

The Financial Supervisory Service announced on the 25th that a total of 923 transactions violated the foreign exchange transaction laws last year, of which 871 were administratively sanctioned (penalty fines and warnings) and notified 52 cases to the prosecution.

In terms of transaction types, △ 51.8% (478 cases) of all overseas direct investors (923 cases), followed by △ 13.6% (126 cases) of cash loans △ 8.9% (82 cases) of real estate investment △ 4.9% (45 cases) of securities trading ) Back followed.

The Financial Supervisory Service demanded the attention of financial consumers as individuals or companies are often disadvantaged for violating foreign exchange transaction laws because they are not well aware of their reporting and reporting obligations under the Foreign Exchange Transactions Act.

Under the Foreign Exchange Transactions Act, parties are obligated to inform the head of the foreign exchange bank, the governor of the Bank of Korea, or the Minister of Strategy and Finance of the status of complying with the procedures for reporting new or changed reports, reporting, and payment/receipt according to the situation in foreign exchange transactions.

However, there are many cases where the parties to the transaction do not recognize or neglect the reporting obligation itself. This is evidenced by the fact that, among the status of violations of obligations, violations of the obligation to report new foreign direct investments and real estate investments accounted for the largest number of 52.1% and 63.4%, respectively.

In particular, in the case of foreign direct investment, the proportion of violations of reporting obligations (25.6%) after the initial report was relatively high compared to other types of transactions.

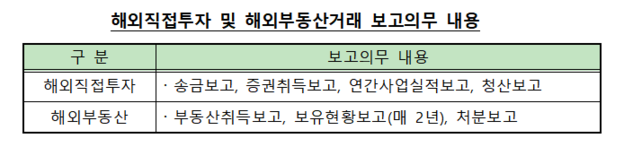

Foreign direct investment is obligated to report on remittance, securities acquisition, annual business performance report, and liquidation report, and for overseas real estate transactions, report on real estate acquisition, holding status report (every two years), and disposal report.