This year, individuals’ direct investment craze continues. There are not fewer people taking money from funds to invest in stocks. This year, the amount of money that has been withdrawn from domestic equity funds for three weeks amounted to 1.6 trillion won. The rapid growth of ETFs is also a threat to public offering funds. In the midst of this, some funds came in. This is due to the increasing number of investors turning to funds investing in the global market as they moved sideways after the domestic stock market peaked.

○ Money focused on the global growth industry

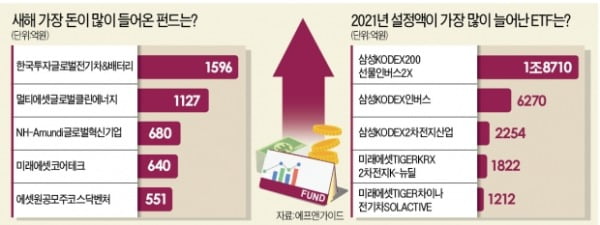

Money is coming into funds that invest in global growth industries. ‘Korea Investment Global Electric Vehicle & Battery Fund’ is a representative example. A new inflow of 159.6 billion won this year. This fund was created with the intent to invest heavily in mobility innovative companies. Samsung SDI including Tesla, Nio, Apple, Nvidia, etc.(792,000 +6.31%), LG Chem(975,000 -1.32%) Etc. It also invests in Qualcomm, Alphabet (Google), and General Motors (GM). The yield is also high. The 1-year return is 88.36%, and the 3-year return is 53.17%. The reason why investors continue to flock to funds with high returns is due to their growth potential. “The mobility data market, which Tesla is leading, is a completely different concept from the automobile industry,” said Kim Joon-sung, a researcher at Meritz Securities. Evaluated.

The second fund that has received a lot of money is the’Multi Asset Global Clean Energy Fund’. It is one of two funds with an increase of more than 100 billion won this year. The fund, which was set up in the spirit of the government’s “Green Growth Fund” in 2009, is attracting attention again thanks to the eco-friendly policies of US President Joe Biden, a Korean Green New Deal. The rate of return in the last six months has exceeded 90%. The three-year (184%) and five-year (317%) returns are also overwhelming. It mainly invests in companies related to renewable energy such as solar and hydrogen. As of the end of August of last year, the fund portfolio includes US solar companies First Solar and Inphase Energy. In particular, In-Phase Energy, which was recently included in the S&P 500, achieved a return of 560% last year.

○ KOSDAQ public offering stocks opportunity

‘NH-Amundi Global Innovative Company Fund’ (68 billion won) and’Mirae Asset Core Tech Fund’ (64 billion won) are also attracting attention from investors this year. It is a fund that evenly invests in innovative companies. The NH-Amundi Global Innovative Company Fund mainly invests in U.S. listed companies with a market capitalization of less than 50 trillion won, such as Marvell Technology, a system semiconductor company in the United States, and Exact Sciences, a diagnostic company specializing in cancer. Japan Computer, the No. 1 motor company, which is said to be the myth of the Japanese manufacturing industry, is also included in its portfolio.

Mirae Asset Core Tech is the only fund that invests in domestic stocks among the top funds whose set amount has increased this year. Constituent items are Samsung Electronics(86,800 -1.48%), SK Hynix(128,500 -2.28%), Samsung SDI, Naver(343,500 +6.51%) Etc. An official of Mirae Asset Management explained, “We mainly invest in technologies with high entry barriers, companies with the potential to localize core technologies, and companies with high growth in the industry.”

As the public offering stock continues, money is flowing into the KOSDAQ Venture Fund. According to F&Guide, a fund evaluation company, a total of 136.7 billion won has flowed into 17 KOSDAQ venture funds since the beginning of the year. There is still a lot of interest as the KOSDAQ market offers priority allocation of publicly available stocks, and the system to deduct 10% of the investment amount is extended until 2022. Among them, the most money was concentrated in the’Asset One Public Stock KOSDAQ Venture Fund’ (55.1 billion won). Lim Seong-cheol, a researcher at Heungkuk Securities, analyzed that “small and mid-cap stocks have been relatively sluggish due to the large-cap rally.”

○ The trend of ETF is inverse and electric vehicles

The ETF market is still hot. This is because of the attractiveness of being simpler than funds and less risky than stocks. Compared to other countries, the rush of funds to inverse ETFs, which are visited by more domestic investors than other countries, is a representative reason for the rapid increase in the amount of ETFs set up. In fact, only the’Samsung KODEX 200 Futures Inverse 2X’, which is called the’Kub Bus’, has inflowed KRW 1.87 trillion this year. Samsung KODEX Inverse’s set amount, which has increased since the beginning of the year, reached 627 billion won.

In the ETF market, the heat for electric vehicles and batteries was also hot. In addition to the Inverse ETF,’Samsung KODEX secondary battery industry’ (2254 billion won),’Mirae Asset TIGERKRX secondary battery K-New Deal’ (182.2 billion won), and’Mirae Asset TIGER China Electric Vehicle SOLACTIVE’ (121.2 billion won) were listed in the top 3~5 places. .

Reporter Park Jae-won [email protected]