Enter 2021.02.20 06:00

However, as the reception increases too rapidly, the savings bank’s concerns are deepening. Banks use the money entrusted by customers to make loans and earn interest income or reinvest them to make money, because there is currently no place to make money due to government regulations and economic conditions. Some savings banks have started to adjust the speed, such as lowering the interest rate for deposits and savings.

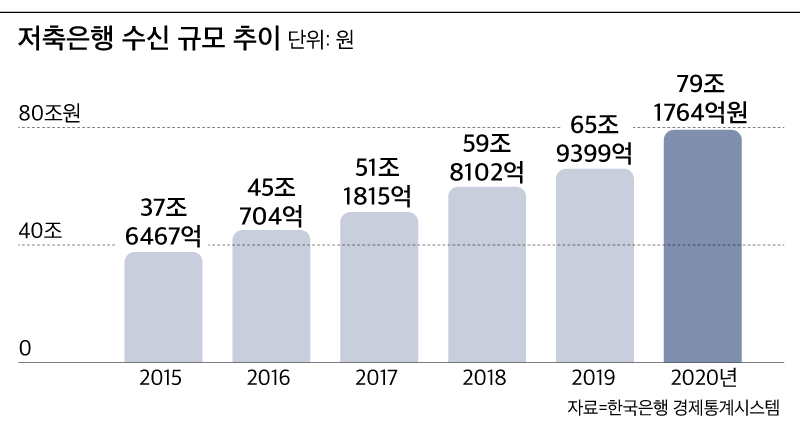

The total amount of savings bank receipts rose to 76,792.6 billion won in 2010, but fell to 37,646.7 billion won in 2015 after the insolvency of savings banks in 2011. However, since then, it has steadily increased, exceeding 70 trillion won in one year after surpassing 60 trillion won in 2019, and is also nearing 80 trillion won.

Savings banks’ receiving growth is more pronounced compared to banks. The bank’s total receipts were estimated at 2107,9181 billion won last year. This is a 10.9% increase from the previous year (1900 trillion 225.7 billion won). It was also a record high and recorded double-digit growth, but the growth rate is half that of savings banks.

Savings banks are worried about the fact that the rate of increase in reception is too fast. This is because it can act as a’debt’ for savings banks as it has to pay interest to consumers as much as it has entered. The savings bank reception growth rate reached 16.2% in 2015 and has continued to double-digit for six consecutive years until the end of last year.

A savings bank official said, “There is also a limit to paying out loans with the incoming money, so if too much reception is accumulated, it is a burden on the bank.” said.

Large savings banks are lowering deposit and savings rates to slow down the rate of increase in receipts. OK Savings Bank has lowered the interest rates of’OK Term Deposits’ and’OK Term Deposits’ from 1.7% per year to 1.6% from the 17th, and SBI Savings Bank has also reduced term deposits for more than 12 months from the 18th. The interest rate was lowered by 0.1p from 1.8% per year to 1.7%.

The recent increase in savings bank receipts is related to a lower bank note receipt rate. A savings bank official explained, “Because the standard interest rate is low, it is difficult to increase the deposit and savings interest rates of commercial banks, so the attractiveness of savings banks with relatively high interest rates has emerged.” Most of the 12-month deposit and savings interest rates provided by commercial banks are in the 0% range, but savings bank deposit and savings interest rates average 1.82% and 2.42%, respectively.

The introduction of a mobile platform also helped secure savings bank customers. A savings bank official said, “Most of the existing savings bank customers were in their 40s to 60s, but as the mobile platform became active, the number of younger customers increased significantly.” It seems that reception has increased as it progresses.” In the case of’Cider Bank’, a mobile platform operated by SBI Savings Bank, about 95% of about 700,000 subscribers are known to be in their 20s and 40s.

As savings banks have been able to enter the retirement pension market since 2018, the scale of related deposits and savings is also increasing. Currently, 28 savings banks nationwide make periodic deposits and installments for retirement pensions and provide them to retirement pension sales channels such as banks and securities companies. According to the Korea Federation of Savings Banks, the balance of savings bank retirement pension deposits and savings rose from 1.2 trillion won at the end of 2018 to 11.3 trillion won at the end of November last year.