In November of last year, the fifth-largest NAND flash company Micron, the US, released’Surprise News’. It was news that the world’s first 176-layer NAND flash was supplied to customers. It is a product that Samsung Electronics and SK Hynix have yet to mass-produce. It wasn’t the end. In January of this year, Micron declared that “the 4th generation 10nm (nanometer, 1nm = 1 billionth of a meter) DRAM was mass-produced.” It is also the first in the world. The domestic industry, which was hit twice by Micron, was shocked.

Micron Takes’World’s First’ Title

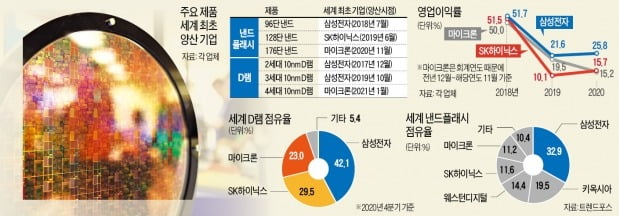

The world’s No. 1 memory semiconductor is shaking amid fierce competition for’own semiconductor support’ from countries around the world such as the United States and the European Union (EU). As of the fourth quarter of last year, 71% of the DRAM market and 45% of the NAND flash market are dominated by Korean companies such as Samsung Electronics and SK Hynix.

When determining business competitiveness in the semiconductor industry, △ technology and cost (yield) competitiveness △ market response capability △ facility investment capability, etc. are used as indicators. The fact that domestic companies have lost the world’s first title to Micron twice in a row is evidence that technology, a key competitive indicator, is being threatened. Until a year or two ago, the technology gap between the world’s No. 1 Samsung Electronics and the third-largest companies such as Micron was about two years.

For example, in NAND flash, Samsung Electronics mass-produced 96-layer V-NAND in July 2018, and SK Hynix in June 2019 to mass-produce 128-layer 4D NAND for the first time in the world. Micron began producing 128-layer NAND only in the second quarter of 2020. In DRAM, Samsung Electronics took the first title related to the 1st~3rd generation 10nm DRAM (1a·1b·1c DRAM). However, it is difficult to predict how long the formula of’Korea = World No. 1 DRAM Title’ will last.

Semiconductor technology that has reached the’limit level’

The biggest reason for the narrowing of the skills gap is the’No. 1 trap’. As the ultra-fine process approaches its limit, it is much more difficult for the top-ranked company to advance one step more than for the latecomers to follow ten steps.

In the meantime, Samsung Electronics has invested trillions of funds and more than a year of time for R&D to develop new technologies. Latecomers spent much less time and money to catch up with Samsung Electronics. This is because you can refer to the technology roadmap. Lee Jong-ho, head of Seoul National University’s Semiconductor Research Institute (Professor of Electrical and Information Engineering), said, “Because select companies have to go while overcoming technical difficulties, the development speed is inevitably slow.” The development situation continued.”

Some analyzes show that the improvement of semiconductor technology has reached its limit. It means that the technology has evolved so that it is not easy to take a half step instead of one step. Director Lee diagnosed that “D-RAM technology in the early 10nm range that companies are developing is’the state of art’. It is difficult to say that the number 1 company has suddenly developed ‘8nm DRAM’.” .

Government support is’one-fifth’ of the US

Analysis that Korean companies are superior in cost competitiveness and facility investment is dominant, but there are also evaluations that Micron and others have’closed up’ recently. Cost competitiveness can be determined by operating margin. In 2019, Micron was 19.5% (December 2018-November 2019), which was less than Samsung Electronics (21.6%), but it was almost twice as high as SK Hynix (10.1%). Last year, Samsung Electronics ranked first with an operating margin of 25.8%, but the gap between SK Hynix (15.7%) and Micron (15.2%) was not large.

The difference in the size of facility investment is also expected to weaken. Recently, the governments of major countries, such as the US and the EU, are preparing a plan for funding more than 100 trillion won to foster the semiconductor industry. The EU investing 180 trillion won by 2030 is considered a representative example. It is predicted that Micron will also receive full support from the government in accordance with the US policy of’strategic weaponization of semiconductors’.

Samsung Electronics is in a situation where it has to disperse its facility investment, which had been focusing on memory, to system semiconductors such as foundries (consignment production of semiconductors). It is not easy to lean on the government. According to a report released by the National Federation of Businessmen in June of last year, the proportion of government subsidies to sales of SMIC in China was 6.6% (2014-2018). Micron’s government subsidies accounted for 3.3% of its sales. For Samsung Electronics and SK Hynix, this ratio was only 0.8% and 0.5%, respectively.

Experts analyzed that in order for Korean companies to survive, they should focus on diversifying product portfolios and securing customers. Companies also know. In last year’s business report, SK Hynix evaluated that “the competitive paradigm is rapidly shifting around profitability through increasing product value.” Some achievements are also coming out. Samsung Electronics recently unveiled’HBM (high bandwidth memory)-PIM (processor in memory)’, which reduces the role of the central processing unit (CPU) by installing an AI processor on a memory semiconductor. Related papers were also published at ISSCC, the most prestigious academic society in the semiconductor field.

Reporter Hwang Jeong-soo [email protected]