Photo = Yonhap News

Celltrion announced the results of phase 2 clinical trials for COVID-19 treatment on the 13th(329,000 -6.67%)Shares of the company fell for two days in a row. This is because the expectation that the effect of improving earnings from the treatment will not meet expectations. The results of Phase 2 clinical trials announced by Celltrion confirmed that the treatment was effective for some patients, but it is difficult to say that it showed overwhelming performance compared to competing treatments, and the market size is also limited.

On the 15th, Celltrion closed the deal at 329,000 won, down 6.67%. The stock price decline over the last three trading days reached 14.32%. During this period, foreigners and institutions net sold Celltrion shares worth 91.8 billion won and 104.6 billion won, respectively. Celltrion Healthcare (stock price -16.86% after the 13th) and Celltrion Pharmaceutical (-16.33%), which together with Celltrion, constitute the ‘3 Celltrion Brothers’, are also on the decline.

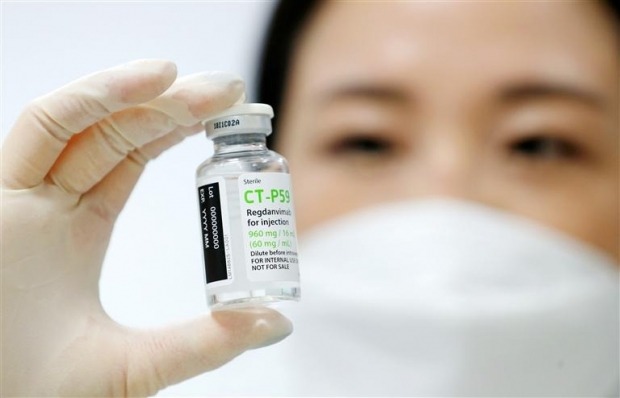

Celltrion’s stock price, which had been close to its record high until the 12th, has plunged as a result of the clinical outcome of the COVID-19 treatment. Celltrion announced the results of phase 2 clinical trials of the injectable Corona 19 antibody treatment “Reekyronaju (ingredient name Legdanbimam CT-P59)” after the market closed on the 13th. According to this announcement, Rekirona reduced the incidence of severe patients requiring inpatient treatment by 54% for all patients and 68% for moderately ill patients over 50 years old. The P value, an index showing the significance of statistics, was 0.05 or higher in all except for the patients in their 50s or older. In general, clinical data for new drugs in the pharmaceutical industry are considered to be meaningful only when the P value is less than 0.05. Lee Myung-sun, a researcher at Shinyoung Securities, explained, “Since we were conducting small-scale clinical trials for rapid development, we could not secure statistical significance.”

The results announced through the phase 2 clinical trial explain that it is difficult to justify the sharp rise in the stock price and expectations resulting from the drug development announcement. An official in the pharmaceutical industry said, “It is difficult to directly compare the major corona 19 treatments such as remdesivir, dexamethasone, and rekirona, as the indicators used in the clinic are all different. It is expected to be administered in such a way that,” he said. “In this case, the potential market size may be limited.”

Foreign Credit Swiss estimated in a report released last month that “Even if we assume the most optimistic scenario, the maximum profit that Celltrion can get from selling treatments is around 400 billion won.” Celltrion’s stock price surged 101.97% last year, and the market cap increased by 23 trillion won, compared to 400 billion won in one-off profit growth.

Reporter Jeon Beomjin [email protected]

Ⓒ Hankyung.com prohibits unauthorized reproduction and redistribution