Reduction of 8.8 trillion won in tax revenue from January to November compared to last year, and expenditure increases due to additional supplements

Until last November, it was found that the country’s households had a deficit of close to 100 trillion won.

The national debt exceeded 826 trillion won, a record high.

In the case of the novel coronavirus infection (Corona 19), income decreased due to cleaning support such as a delay in tax payment, while expenditure increased due to the execution of funds for the 4th supplementary budget (additional budget).

◇ Decreased corporate tax, etc. From January to November, 8.8 trillion won was removed

On the 12th, the Ministry of Strategy and Finance released the’Monthly Fiscal Trends’ January issue, which contains the status of Nara Salim until last November.

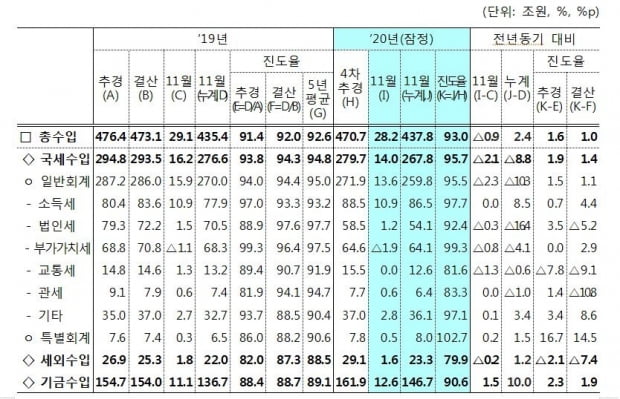

From January to November of last year, national tax revenue was 267 trillion won.

It was found that 8 trillion won of tax was removed less than the same period a year ago.

Compared to the previous year, corporate tax (-16 trillion KRW) decreased the most.

It is analyzed that the economy has been bad since 2019 and the impact of the 2020 Corona 19 incident.

Value-added tax (-4 trillion KRW), tariffs (-1 trillion KRW), and transportation tax (600 billion KRW) also decreased.

On the other hand, income tax (8.5 trillion won) increased.

This is because there is a side that was less hit by Corona 19 than corporate tax, and capital gains tax has also increased.

Other national taxes (3.4 trillion won) such as comprehensive real estate tax, securities transaction tax and stamp tax also increased.

Although national tax revenue decreased, total income increased by 2.4 trillion won to 437 trillion won, as non-tax revenue and fund income such as fines increased.

However, with four additional additions last year, the increase in total expenditure compared to the same period last year was much larger than that of gross income.

The total expenditure from January to November increased by 57.8 trillion won to 501.5 trillion won.

◇ Management fiscal deficit of 98.3 trillion won, more than twice the previous year

As a result, the size of the deficit in the fiscal balance of households in Nara Salim also increased.

From January to November of last year, the combined fiscal deficit increased to 63 trillion won, an increase of 55 trillion won.

The administrative fiscal deficit, which shows the actual fiscal situation of the government by subtracting social security funds such as the national pension, increased by 52.7 trillion won to 98.3 trillion won, which is close to 100 trillion won.

Both the consolidated fiscal balance and the managed fiscal balance are the largest in history as of January-November.

During the same period in 2019, the integrated fiscal deficit was KRW 7.99 trillion and the managed fiscal deficit was 45 trillion KRW.

As of the end of November, the central government’s debt was 86.2 trillion won.

This is an increase of 13 trillion won from the previous month.

Considering the figures for December, which have not yet been disclosed, last year’s fiscal deficit and national debt are expected to increase further.

As of the end of last year, the fiscal balance and national debt will be announced at the end of the fiscal year in April of this year.

As predicted in the 4th supplementary administration, the government’s management fiscal deficit in 2020 is expected to be able to manage at 111.6 trillion won and the national debt at 84.6 trillion won.

◇ One month in November was also deficit… Reduced tax revenues and increased expenditures

The increase in the fiscal deficit and national debt from January to November of last year was influenced by the bad situation in the country’s livelihood in November.

In November of last year, the government’s total revenue was 28.22 trillion won, down 900 billion won from a year ago.

Fund income increased by 1.5 trillion won, but national tax revenues such as corporate tax (300 billion won), additional tax (800 billion won) and transportation tax (-1300 billion won) decreased.

On the other hand, total expenditure increased by 6,9 trillion won from a year ago to a total of 32.6 trillion won due to the 4th supplementary business such as childcare fees and job search benefits, and the execution of ordinary grant tax.

As a result, in November, the consolidated fiscal balance recorded a deficit of 4.3 trillion won, and the managed fiscal balance recorded a deficit of 7 trillion won.

In October, the consolidated fiscal balance and the managed fiscal balance were surpluses of 21 trillion won and 17 trillion won, respectively, but turned to deficit in one month.

Due to the VAT paid in January, April, July and October, the decrease in revenue in November from October seems to have affected the turn of the deficit.

On the other hand, out of 39.3 trillion won last year’s early execution management target project by central ministries and public institutions, it was 28.84 trillion won, which is 92.1% of the annual plan.

/yunhap news