The Fair Trade Commission is tightening the surveillance network for various O2O (on-offline linkage) platform companies such as delivery apps such as the people of delivery, used trading markets, and Google Play Store. While targeting’platform companies that increased profits through Corona 19′ as the first target of applying the’profit sharing system’ in politics, pressure on major platform companies is increasing.

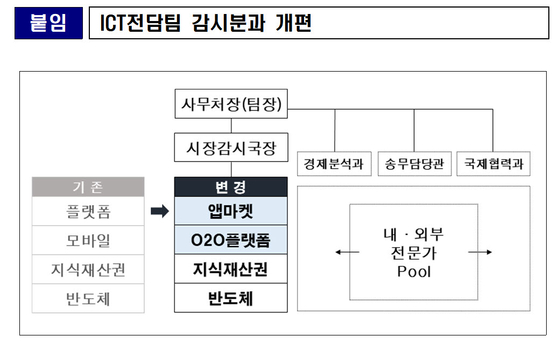

The Fair Committee announced on the 18th that it has newly created the App Market Division and the O2O Platform Division under the Monitoring Division of the Information and Communication Technology (ICT) dedicated team. The ICT team, launched in November 2019, is an organization designed to handle unfair behavior cases of major domestic and foreign platform companies and respond to future lawsuits. The focus of monitoring in the newly established App Market subdivision is the act of hindering the emergence of mobile operating systems (OS) and harming competition in the related app market and other smart device markets. It also monitors the behavior of preventing developers from launching apps to competitive markets, and forcing them to use specific payment methods. This is interpreted as a measure with Google sanctions in mind.

Source: FTC

The’O2O Platform’ section looks at platform companies that have a close influence on people’s lives, such as delivery, second-hand transactions, and lodging apps. It monitors the act of forcing the sale of goods and services by applying the most favorable price and transaction conditions on the company’s platform, artificially adjusting the exposure ranking on the platform, or deceiving consumers with unclear advertisement display.

This is the FTC’s explanation that it will focus its law enforcement capabilities in the platform sector, which is increasing its influence in the digital economy. However, platform companies are fully affirming that the intensity of the FTC’s platform’prisoner’ continues to increase. Since last year, the FTC has been promoting the enactment of the’Platform Fairness Act’ that regulates unfair behavior of online platform companies, and the revision of the E-Commerce Act to strengthen platform operators’ responsibility.

In particular, as the discussion on the profit-sharing system has intensified, focusing on the passport, platform companies are being confused as the’first hitters’ of its application. Platform companies that have enjoyed reflective profits from Corona 19, such as Naver, Kakao, elegant brothers, and Coupang are targeted. One platform company executive who requested anonymity said, “Most companies are already implementing various policies such as providing commissions or donating funds for small business owners who have been damaged by Corona 19, and implementing various policies such as returning advertisement expenses and supporting loan interest.” “We are not considering the fact that this is so fierce that we have not yet recovered the investment cost.”

Source: National Federation of Businessmen

The issue of equity with foreign companies also emerges. Foreign companies such as Netflix and YouTube have increased their domestic market share due to Corona 19, but it is unlikely that they will participate in the profit sharing system. Eventually, domestic companies can face reverse discrimination.

The National Federation of Businessmen said, “If the profit-sharing system is applied to foreign companies such as YouTube and Netflix, it is highly likely that the profit-sharing system will be applied only to domestic companies. It works like a quasi-tax limited to in the country, which could lead to a problem of competing at a different starting line with foreign companies.” He added, “The domestic companies may be disadvantaged in the competition with foreign companies.”

Reporter Hae-Yong [email protected]