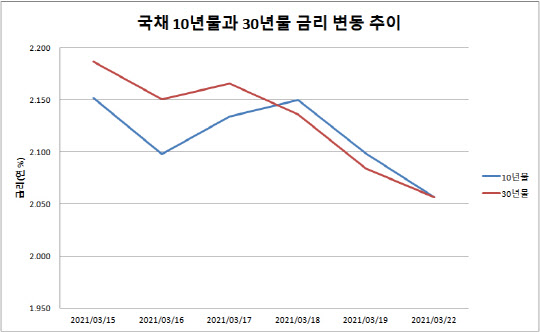

According to market points on the 23rd, the 20-year Treasury bond rate is 2.072% per year, which is 0.022 percentage points higher than the 30-year bond rate (2.05%). The 10-year bond rate fell to 2.032% per year, lower than the 30-year bond, due to the effects of oral intervention by the Ministry of Information and Transportation and the stabilization of the 10-year Treasury bond rate by 1.6%. From the 18th to the 19th, 10-year interest rates showed a reversal of 0.014 percentage points and 0.015 percentage points, respectively.

|

Long and short-term interest rates in the bond market reversed.. “The cause of the bond forward supply and demand?”

In the bond market, an analysis suggests that the strong demand for the ultra-long-term market is caused by the demand side. It is interpreted that insurance companies have increased demand for ultra-long term products such as 30-year products to expand financial soundness ahead of the introduction of the new International Accounting Standards for Insurance Contracts (IFRS17) in 2023.

Generally, insurance companies have a longer debt duration than assets. For products such as life insurance, there is a repayment amount, that is, a debt, to be paid to the subscriber after a few decades, because the period is relatively longer due to the nature of the insurance company. However, when IFRS17 is introduced two years later, the duration, which is the average maturity of liabilities and assets, needs to be adjusted to a certain extent and the level of solvency (RBC) needs to be increased.

In fact, in the recent bond market,’Bond Forward’ trading, which delivers 30 years after 5 years, has been actively taking place. It has been expected that the transaction will increase after the financial authorities decided to reflect the bond forward in RBC calculations from September last year. In simple terms, a bond forward transaction is a contract that buys a bond at a set price at a certain point and sells it back after a certain period of time. A securities company buys a 30-year bond and holds it for 5 years, and then sells the bond with a maturity of 25 years to an insurance company. The increase in bond-forward trading acts as pressure to buy ultra-long-term bonds and lower interest rates.

The buyer, the insurance company, can bring 30 years of money without spending any money right away. For securities companies and banks, which are counterparties of insurance companies, the more the yield curve stiffens (long- and short-term interest rate differences), the better a structure to make a profit is formed. For a brokerage firm, if a five-year loan is sold for a bond forward transaction, the 30-year interest rate should be higher than the combined loan fee and the five-year interest rate.

Hye-young Woo, a researcher at Ebest Investment & Securities, said, “There is a lot of talk about bond forwards about the reason why the interest rate reversal between ultra-long term and short term interests occurs. It seems that such a deal was active as the curve met the straining prerequisites.”

“In addition to the influence of the insurance company, which is an actual consumer, the securities side has an effect on the trading side,” said Cho Yong-gu, a researcher at Shinyoung Securities. “The bond issuance book (the limit on fund management) exceeds 20 trillion won, although the big loss has been transferred to large securities. The securities company sells principal bonds to insurance companies among the two types of strip bonds separated by principal and interest. When they hand over to an insurance company, they raise the price based on the closing price and pass it over expensively to gain profits,” he explained.

The BOK is also polite to the bank… Ministry of Information “We will expand the issuance of 30 years”

Financial authorities are paying close attention to the recent reversal of the yield curve for the ultra-long term as the volatility of the Treasury market has increased recently, including the rise in US Treasury yields in addition to the issue of introducing IFRS17.

Kim Yong-beom, the first vice minister of the Ministry of Strategy and Finance, said on the day, “The investment sentiment in the government bond market is shrinking and volatility is expanding.” As much as it is, we will make every effort to stabilize the market, such as flexible adjustment of the issuance of government bonds.”

Researcher Cho Yong-gu said, “It is not possible to adjust the supply and demand by maturity in trillion units from the annual government bonds that are already scheduled to be issued, but the supply and demand ratio can be adjusted in units of 100 billion won.”

Bank of Korea Finance and Monetary Commission members of the Bank of Korea also mentioned that the government should regulate the supply and demand for issuance of government bonds in the very long term. At a monetary policy meeting held on the 25th of last month, a member of the bankruptcy committee said, “The yield curve in Korea is exceptionally flat in the very long range from 10 to 50 years due to strong demand for long-term bonds from insurance companies and pension funds.” It will have the effect of easing the supply-demand imbalance and normalizing the shape of the yield curve.”

However, some point out that in the market, responding to the issuance of ultra-long-term bonds such as only 30-year bonds may only be a temporary effect in adjusting the short- and long-term interest rate reversal. Kim Sang-hoon, a researcher at KB Securities, said, “The financial authorities can adjust the speed, but it will be difficult to change the direction of interest rates unless there are events that will trigger an economic downturn, such as a serious side effect of the vaccine.”