TSMC running while Samsung plant stopped, sales in February 14% ↑

[아시아경제 우수연 기자]TSMC, the No. 1 global foundry company, saw a 14% increase in sales in February this year compared to the previous year. While Samsung Electronics’ Austin Foundry plant has stopped due to a cold wave in the US, its rival TSMC is enjoying the benefits of improving the semiconductor industry by increasing its utilization rate.

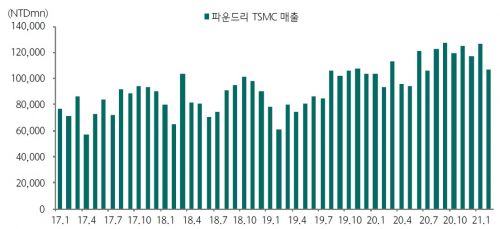

According to industry sources on the 13th, TSMC’s sales in February of this year were $3.76 billion ($106.53 billion based on Taiwanese dollars), an increase of 14.1% year-on-year. Compared to the previous month, the number of business days decreased due to the Lunar New Year holidays, which decreased by 16%, but compared to February of last year, a clear improvement was confirmed.

The industry interprets that the reason for the increase in February sales compared to the previous year is that the sales of advanced’advanced processing’ of 14nm or less remained solid. Previously, TSMC announced a plan to invest in facilities this year at $25 billion to $28 billion, and announced plans to focus more than 80% of them on advanced processes.

TSMC monthly sales/data = Hana Financial Investment

In addition, the global semiconductor market’s increased dependence on TSMC as factories located in the southern United States such as Samsung Electronics, NXP, and Infineon continued to shut down, which contributed positively to sales growth. In Japan, TSMC’s influence in the global foundry industry is gradually expanding, with the Renesas plant temporarily stopped due to an earthquake. In a situation where the semiconductor supply is already scarce, such a short-term shutdown can also lead to a major shock to the market.

Prospects that semiconductor prices will increase due to the shortage of foundry supply are also raised one after another. It can be an opportunity to improve profitability for companies such as TSMC, which continue to increase utilization rates. Kim Kyung-min, a researcher at Hana Financial Investment, analyzed that “Average selling price (ASP) is expected to rise due to a shortage of foundry, and TSMC’s monthly sales are expected to exceed the level of 120 billion Taiwan dollars.”

Meanwhile, Samsung Electronics, a rival, is inevitable for a short-term loss due to the impact of its Austin plant in the US. The Austin plant, which has been shut down since the 16th of last month due to a power outage in Texas, has recovered power in about a week, but it is still not fully operational. As the shutdown period lasts for about a month, the industry estimates a loss in sales of between 300 billion and 400 billion won.

Hwang Min-seong, a researcher at Samsung Securities, said, “Samsung Electronics’ Austin plant started restarting in mid-February, but it is estimated that the full recovery will take place in May.” Said.

Reporter Woo Woo Yeom [email protected]