Foreign currency deposits are evolving. There are also products that are automatically canceled when investors achieve the desired exchange rate level. Products that can be invested in small amounts are also gaining popularity.

Fee waiver after one month of subscription

Small and non-face-to-face, preferred for young people

According to banknotes on the 3rd, the five major commercial banks (Woori, Shinhan, KB Kookmin, Hana, and NH Nonghyup) had a dollar deposit balance of $50.3 billion last month. Since September last year ($47.9 billion), it has increased by $2.4 billion (5%) in four months. This is because demand for converting the won to the dollar and putting it in deposits increased as the weak dollar and the strong won continued for a while.

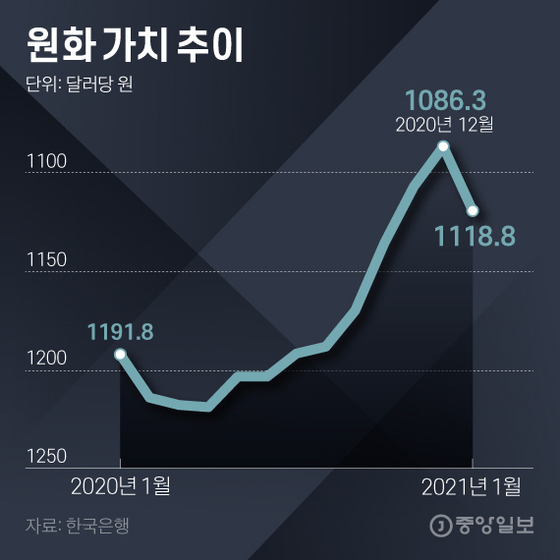

Won value trend. Graphic = Younghee Kim [email protected]

On the 3rd, the value of the won in the Seoul foreign exchange market ended at 1114.9 won per dollar, which was 2.8 won higher than the previous day (the exchange rate fell). The value of the won, which turned upward before and after the US presidential election in November last year, peaked on the 4th of last month (1082.1 won per dollar) and turned downward.

KB Kookmin Bank introduced’KB TWO Tech Foreign Currency Term Deposit’, which includes an automatic termination function, on the 2nd. It is a product that automatically cancels when the exchange rate level specified when a customer sign-up is exceeded and converts it into KRW. An official from Kookmin Bank explained, “We planned a product aimed at investors who want time deposits in foreign currency, aiming at foreign exchange gains.”

Hana Bank launched the’daily dollar foreign currency installment savings’ in September last year. It is a savings product that allows you to freely pay up to $1,000 per month for 6 months. Customers can save a dollar if they want. One month after signing up, you don’t have to pay a fee to find foreign currency in cash. This product has exceeded 10,000 accounts within a month of launch. As of the last day, the number of accounts recorded 58300.

Shin Ji-sook, deputy head of Hana Bank’s Future Finance Division, said, “It is a product that can be subscribed for on a small or non-face-to-face basis, so it is popular with young people.”

In October of last year, NH Nonghyup Bank launched the’NH Main Transaction Preferential Foreign Currency Savings Deposit’ that combines Korean won and foreign currency savings products. When a customer who has subscribed to the existing’NH Main Transaction Preferential Savings’ subscribes to a foreign currency deposit product (NH main transaction preferential foreign currency savings deposit), preferential interest rates of 0.1% points are applied to each.

At the end of last year, the Bank of Korea counted $1.78 billion in dollar deposits held by individuals. It increased by 15.8% from January of last year ($15.35 billion). However, it should be noted that if the won value declines after buying the dollar in anticipation of a further increase in the won’s value, it may result in an exchange loss.

Baek Seok-hyun, a researcher at Shinhan Bank, said, “Foreign currency products aimed at short-term exchange rate gains have risks such as short-term exchange rate volatility.”

Reporter Yoon Sang-eon [email protected]