“Save your premium!”

Getty Images Bank

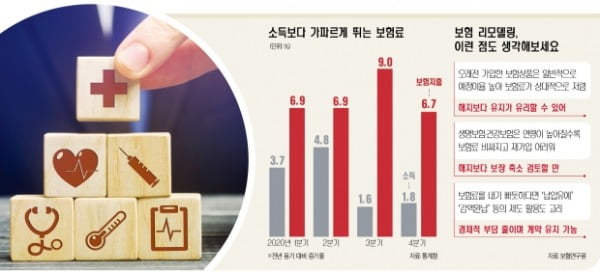

Interest in’insurance remodeling’, which checks consumers’ insurance subscription details, sorts out products with low cost-effectiveness (price/satisfaction), and adds new products, is increasing. The fact that the number of people whose wallets have become thinner since the Corona 19 crisis is also the background of insurance remodeling is drawing more attention. However, some point out that if the individual situation is not carefully reviewed, it can lead to a’not done’ redesign. Something that keeps holding it can even cancel products that are beneficial to consumers. In a recent report, the Korea Insurance Research Institute pointed out that “if insurance remodeling does not accurately consider changes in the risk of the contractor, side effects of not enjoying the insurance benefits may occur.”

○ Insurance remodeling, hopefully 藥 毒 if wrong

Insurance remodeling refers to overall analysis of insurances subscribed by an individual to find duplicate or insufficient coverage, and to change the composition of products by selecting the products to be canceled and alternative products. Insurance companies and agencies (GA) are actively promoting them through phone calls, home shopping, and advertisements.

Insurance remodeling itself is not a bad thing. It can be an opportunity to increase the cost-performance ratio while improving the efficiency of the guarantee. For example, if you are a retired family head with your children independent, reducing the share of death coverage and increasing the share of disease coverage is not a bad choice. Medical expenses continue to increase as inflation increases, and new treatments such as targeted anticancer drug treatments that cannot receive insurance payments with old products are increasing. As the cure rate of diseases increases, the burden of post-treatment medical care and living expenses has increased rather than medical expenses.

The problem arises when insurance remodeling focuses solely on’premium savings’. Considering the economic burden, it is easy to cancel life insurance, which is expensive in insurance premiums, and add relatively inexpensive health insurance. However, there are quite a few cases, such as getting rid of the death insurance and switching to health insurance, and then dying within two years and not receiving the death insurance at all. Kim Seok-young, a senior research fellow at the Insurance Research Institute, said, “The change in risk faced by the policyholder does not mean the disappearance of a specific risk.” If the insurance for a specific risk is terminated through remodeling, there may be cases in which the insurance cannot be guaranteed in the event of an accident. I said.

Research Fellow Kim explained, “Since insurance sellers earn commission income when they sell new products through remodeling consultation, there is little incentive to mention the importance of existing products.” Insurance cannot be restored to its original state if canceled by itself.

○You know the saying,’Insurance is good for old products’

What to watch out for when remodeling insurance? Once a product was signed up a long time ago and is now discontinued, the cancellation must be decided carefully.

In general, the older an insurance product is, the better it is for consumers, and in many cases it is a loss for insurance companies. In particular, it is better to keep the pension insurance that promises a fixed high interest rate of around 10% per year until the end. It is a product that insurance companies sell and regret for a long time without knowing that the current era of ultra-low interest rates will come.

In the case of cancer insurance, until the mid-2000s, it paid the same diagnosis fee as general cancer for thyroid cancer. These days, cancer insurance provides only 10 to 20% of the cost of diagnosis of general cancer by classifying diseases such as thyroid cancer, breast cancer, and prostate cancer as early detection and treatment as easy as’small cancer’.

In the past, insurance products are usually set at a higher planned interest rate, so insurance premiums tend to be cheaper, so maintenance may be more advantageous than termination. Planned interest rate refers to the expected rate of return that the insurer is expected to obtain by the time the insurance payment is paid by rolling the premiums it has collected from the subscribers. Insurance premiums automatically become expensive when the expected interest rate falls. For insurance products that receive tax benefits, you should also calculate the tax impact before cancellation.

○ Even if the insurance premium is lowered without cancellation, the premium is’tuk’

I like the product, but if the insurance premium is overwhelming, it is worth using another method that can enjoy the same effect as the remodeling.

Insurance companies are operating systems such as’deferment of payment of insurance premiums’, which can maintain contracts without paying insurance premiums for a certain period of time, and’reductions in full,’ which can lower only the amount of coverage while maintaining the period and conditions of the coverage. An industry insider advised, “Life insurance and health insurance are more expensive and difficult to re-enroll as they age,” and advised, “If the need for risk coverage decreases as we get older, it may be desirable to reduce coverage rather than termination.”

Reporter Lim Hyun-woo [email protected]