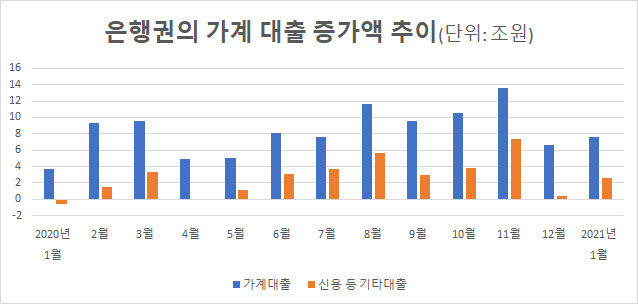

Household loans are rapidly increasing due to demand for housing, stocks, regulatory avoidance, and living expenses due to Corona 19. In the news that there will be a measure to regulate household loans for the Young Kle (to the soul and borrow) and debt (invest in debt) family, the demand to obtain a loan in advance to avoid the regulation overlapped. As loan interest rates are rising rapidly, concerns are growing that household loans are becoming insolvent, centered on the vulnerable groups with low income and low credit ratings. The financial authorities are making all-out efforts to prevent the possibility of household loan insolvency in advance, such as to come up with measures to manage household loans in March.

|

◇ Credit loan surges such as Matong… Interest rates also skyrocketed

According to the Bank of Korea, household loans increased by 7.6 trillion won in January, the largest increase in January since the breakdown of loans in 2004. Including financial sectors such as non-banks, it increased by 10 trillion won. Of these, credit loans increased 4.30 trillion won in the financial sector, including 2.3 trillion won in banks.

The most striking part is the household credit loan, such as a negative bankbook. In particular, the number of negative bankbooks is said to have been opened in January alone over 43,000 (based on the five major banks), and the balance in use is said to reach the mid-1 trillion won. This is interpreted as the impact of a sharp increase in demand to raise stock investment funds to avoid loan regulations. In January, the KOSPI index and the KOSDAQ index exceeded the 3200 and 1000 lines, respectively, stimulating the demand for stock investment.

In this situation, household credit rates are slowly rising. According to the National Federation of Banks, the household loan rates of 18 commercial banks averaged 3.82% in December last year, up 0.43 percentage points from July (3.39%), when the loan rate was at its lowest level.

The loan interest rate is calculated by adding the additional interest rate to the base interest rate (the funding rate of banks such as bank bonds), and then subtracting the adjusted interest rate such as the preferential interest rate. The interest rate raised by banks by issuing bank bonds rose 0.07 percentage points from 0.82% to 0.89% over the same period. However, the additional interest rate rose by 0.41 percentage points from 3.32% to 3.73%.

As a result of the Bank of Korea’s loan behavior survey of 17 domestic banks in charge of loans in mid-December last year, the bank’s general household (excluding home mortgage loans) loan attitude index was calculated from -44 in the fourth quarter of last year to -12 in the first quarter of this year. . The fact that the loan attitude index is negative means that the loan examination will be strengthened.

It is highly likely that this strengthening of the loan review resulted in an increase in the additional interest rate. However, even if the interest rate rose, it was still low compared to the previous year, so it did not prevent the increase in loans. The average loan interest rate in December is similar to the end of June last year (3.83%). In particular, since regulatory measures will come out soon, people who want to get a loan have a strong sentiment to get a loan in advance, and the bank’s desire to increase credit loans before the regulation is met with the desire to increase the amount of loans.

|

◇ Intermediate credit rates have risen further

As loan interest rates are likely to continue to rise, concerns are growing, especially among low-credit and low-income families, that household loans may become insolvent. In fact, when analyzing the rise in credit lending rates by credit rating, the interest rate for December loans for the first and second grades was 3.08%, up 0.34% points from July (2.74%), while the third to fourth grades and the fifth to sixth grades were 3.98% and 5.51, respectively. As a percentage, the rate rose by 0.40 percentage points and 0.38 percentage points.

However, the delinquency rate is still low. As banks sold delinquent delinquent bonds that were overdue in December to manage year-end soundness, the household loan delinquency rate was 0.20% and the credit loan was 0.34%, a record low.

The financial authorities plan to regulate the pace of household loan growth by announcing measures to manage household loans in March. There is a plan to introduce a total debt repayment ratio (DSR) for each borrower. Currently, the DSR regulation is two-track: △Within 40% of home mortgage loans exceeding KRW 900 million and credit loans exceeding KRW 100 million △ Average DSR per individual bank is less than 40%, but by consolidating or adjusting these, the DSR calculation method for each borrower will be changed It is a policy. At the same time, credit loans are reviewing a plan to change the method of repaying principal and interest (principal and interest) in installments, like mortgage loans.

Song In-ho, an associate researcher at the Korea Development Institute (KDI), said, “The amount of loans may be vulnerable to those who are self-employed and use their home as collateral for living expenses, or those who receive loans at high interest rates due to their low credit rating.” At the same time, it is necessary to prepare for the possibility that the repayment pressure of the vulnerable group will increase.”