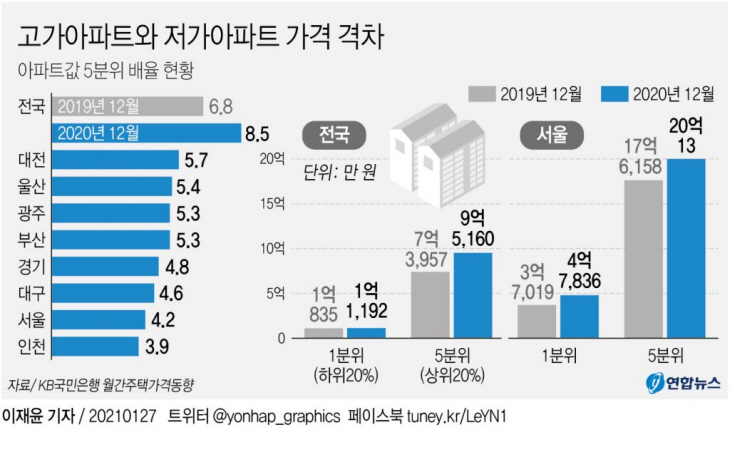

As a result of examining the time series data on monthly housing price trends of KB Kookmin Bank on the 27th, as of December last year, the national apartment quintile ratio was 8.5. It is the highest since December 2008 (8.1), when the relevant statistical survey began.

The quintile multiplier is the value obtained by dividing the average price of the top 20% (5th quintile) by the average price of the bottom 20% (1 quintile) by dividing houses into 5th place in order of price. The higher this magnification, the greater the price difference.

In December of last year, the average price of apartments in the first quintile nationwide was 119.2 million won. It increased by 3.75 million won compared to the same month last year (18.35 million won). On the other hand, the average price of apartments in the fifth quintile was 951.6 million won, a surge of 215 million won from a year ago (7,3957 million won).

|

|

▲ The price gap between high-priced and low-priced apartments. yunhap news |

The national apartment quintile ratio increased from 6.8 in December 2019 to 8.5 in December last year, recording the largest annual fluctuation. As of December last year, the number of quintiles by region was highest in Daejeon (5.7), Ulsan (5.4), Gwangju and Busan (5.3), Gyeonggi (4.8), Daegu (4.6), Seoul (4.2), and Incheon (3.9). . By region, the metropolitan area (6.6), other regions (5.6), and the five metropolitan cities (5.2) in order.

In particular, last year’s △Gyeonggi △Incheon △Busan △Daegu △Gwangju △Daejeon △Ulsan had the highest quintile ratio for apartment prices since the start of a related survey in 2013.

However, in Seoul last year, the quintile ratio (4.2) was the only lower than that of December 2019 (4.8). This means that housing polarization has intensified across all regions except Seoul.

In Seoul, the price of apartments in the first quintile rose from 371.19 million won in December 2019 to 478.36 million won in December last year. During the same period, the price of apartments in the fifth quintile jumped from 1,761.58 million won to 20.13 million won, a new year of 238.55 million won. In the case of Seoul, it is interpreted that even low-cost apartments have increased in price and the ratio has decreased.

Last year, not only apartments, but also the 5th quintile multiplier including single-family, multi-family, multi-family, and alliances showed the same pattern as apartments.

Park Won-gap, a senior real estate expert at KB Kookmin Bank, said, “In the region last year, the procurement power and income gap due to abundant liquidity were reflected in metropolitan cities, and the phenomenon of local wealth formation accelerated.” “The rate of increase in the price of mid- to low-priced homes was steeper than that of high-priced homes due to the influence of panic buying by young people and the government’s real estate regulation policy targeting Gangnam.

“This year, as the demand for purchases from the jeonse crisis continues in Seoul as well as in the provinces, mid- to low-priced homes are attracting attention.” “There is a possibility that the polarization of housing will ease.”