Blocking’debts’… Principal amortization of credit loans

Financial Services Commission, strong prescription of household debt… Expanded application of DSR by individual

中企 Loan maturity extended further… Short sale reintroduction is decided next month

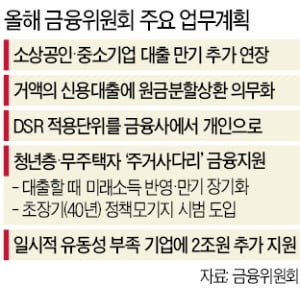

When borrowing more than a certain amount with a credit loan, a principal installment repayment system is introduced, in which interest as well as principal must be paid together. The total debt principal repayment ratio (DSR) system, which limits the amount of money that can be borrowed from the entire financial sector, based on an individual’s annual income, is further strengthened, reducing the individual’s loan limit. The loan maturity extension and interest repayment for small business owners and SMEs will be extended one more time after March.

On the 19th, the Financial Services Commission announced a New Year’s work plan with the same content. In order to manage household debt risk, the Financial Services Commission has made it mandatory for large credit loans to be repaid in installments. Credit loans generally pay only interest during the loan period and then pay the principal at once when maturity returns, but in the future, it will change to repay the principal and interest at the same time like a mortgage loan.

For example, if you received a credit loan of 100 million won with a maturity of 5 years at a 3% annual interest rate, you only need to pay 250,000 won per month and repay 100 million won after 5 years. It means that you have to pay off the equal repayment). The government did not provide specific figures for the amount standard, but the financial sector predicts that it is highly likely to be decided from tens of millions of won. The government sets the standard for applying DSR to individuals at over 80 million won in credit loans.

The Financial Services Commission has implemented a policy to curb the demand for housing by reducing loans, but in November last year, a record high of 4.8 trillion won was lost to credit loans. In the new year, as the’debt investment’ (debt investment) continued in line with the rise in the stock market, analysis shows that the Financial Services Commission came up with a stronger prescription.

Finance Commissioner Eun Seong-soo said at a briefing, “I think investing in real estate and stocks within the scope of one’s own capabilities is right in terms of the soundness of individuals and financial companies.” Regarding the resumption of the short sale, Chairman Eun said, “If the regular National Assembly is held in February, there will be a process of listening to the members of the lawmakers.” “Please wait a little longer for the final decision.”

When the DSR regulation is extended for each individual, the amount of loans seems to decrease dramatically.

The Financial Services Commission decided to strengthen the individual total debt repayment ratio (DSR) along with the regulation on credit loans. Currently, DSR regulations are mandated by financial companies to be managed at an average of 40% or less. It doesn’t matter if banks raise the DSR of one individual to 60% and lower the DSR of another borrower to 20%. Individual DSR was limited to 40% only for apartment purchases of 900 million won or more. The Financial Services Commission will gradually apply the DSR regulations to individual borrowers. The final plan will be confirmed in March.

Financial analysis is that the loan limit can be reduced more than before if the principal installment payment of credit loans and DSR regulations are combined. This is because DSR is based on the repayment of principal and interest payable for one year, so if credit loans must be paid monthly to the principal, DSR increases as a result. An official from the Financial Services Commission warned, “If financial companies increase loans in addition to the funds required to respond to Corona 19, they may penalize the liquidity coverage ratio (LCR) and loan-to-deposit ratio adjustments.”

The Financial Services Commission decided to provide’tweezers support’ to the youth who are most affected by the DSR strengthening measures. This is because if the DSR standard is mechanically applied to young people with little income, the loan limit will be too low, making it difficult to find a home. When receiving a mortgage loan, there is a discussion of increasing the loan limit by reflecting future income, or reducing the amount of principal and interest repayment that must be paid per year while extending the maturity. The Financial Services Commission made a premise that’the situation in the real estate market should be taken into account’, but it decided to introduce a 40-year, ultra-long-term policy mortgage for young people, newlyweds, and first-time buyers in the second half of the year.

In relation to Corona 19, the Financial Services Commission decided to once more extend the loan maturity extension and interest repayment deferral measures that all financial sectors apply to small business owners and SMEs. Chairman Eun Seong-soo explained, “When we comprehensively consider the current quarantine situation, real economy trends, and financial endurance, the extension is inevitable. Even if the economy normalizes, we will not do so in a way to pay back principal and interest at once.” . The amount of loans delayed by the financial sector amounted to 126 trillion won.

Regarding the drop in the legal maximum interest rate from 24% per year to 20% from the second half of the year, the Financial Services Commission cut the interest rate on Sunshine Loan 17 (loan at 17.9% per year to low-credit people who have no choice but to use lenders), and repayment for borrowers on loans exceeding 20% per year. It decided to come up with supplementary measures such as supply of goods. Measures have also been prepared, such as making more loans to financial companies that make more mid-interest loans.

Reporter Park Jong-seo/Kim Dae-hoon/Oh Hyeong-ju [email protected]