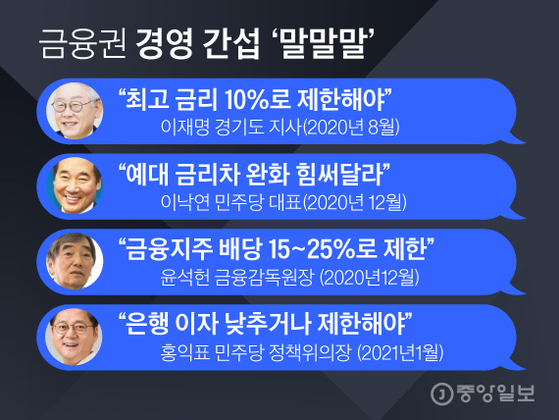

The financial sector was in turmoil as the ruling party and the financial authorities, with the cause of helping small businessmen, poured out contradictory demands. In recent years, prior to the election, the politicians are adding to the’political finance’, which tries to use financial companies as the subject of patronage policies, and the concerns of the financial sector are deepening.

Financial sectors worry about mixed orders

Expert “Financial soundness should be prioritized”

It is the ruling party that has set the stage for’political finance’. Hong Ik-pyo, Chairman of the Democratic Party’s Policy Committee, designated the financial sector, including banks, as the main targets for participation in the profit-sharing system. Chairman Hong argued that “the industry that is profiting the most in the situation of the new coronavirus infection (Corona 19) is the financial industry that takes full interest,” and argued that “the financial industry should also stop or limit the interest of the banking sector.”

The financial resources of the profit-sharing system are partially contributed by the government using public funds or accumulated spare funds, but the private sector’s voluntary donations are used to cover a large portion of the funds. According to the ruling party’s plan, one financial sector, such as a bank, must pay 110 billion won. The logic is to release money because it has benefited from interest income from increased household loans.

On the other hand, the financial authorities are in a position to tighten the money. The Financial Supervisory Service is demanding that the prolonged Corona 19 be refraining from dividends and filling the barns because the scale of insolvent bonds that financial companies have to absorb could increase.

Financial Supervisory Commissioner Yoon Seok-heon suggested in December last year that “we must prepare for possible insolvency due to the prolonged Corona 19,” and suggested that the dividend of financial holdings should be 15-25%, lower than last year (25-27%).

An official from the financial sector said, “The Financial Supervisory Service tells you to save money and prepare for the crisis. Criticized.

Interference in financial management. Graphic = Reporter Kim Kyung-jin [email protected]

There are even talks that the ruling party should encourage participation in the Korean version of the New Deal (K-New Deal) even by easing the ratio of banks’ BIS (International Settlement Bank). In addition, on the 22nd, the Democratic Party brought together the chairman of the five financial holding companies to encourage financial sector investment in the K-New Deal, and proposed a flexible application of the current BIS equity capital regulation.

The BIS ratio is a measure of the soundness of a bank by dividing risk-weighted assets such as loans by equity capital. To keep the BIS ratio and invest in areas with high investment risk, such as new growth industries, it is necessary to accumulate equity capital, which is several times the amount of investment, as a provision. This is why banks and others are bound to be lukewarm in investment. Political circles argue that the BIS ratio should be relaxed so that banks are not obsessed with soundness and actively invest in startups and new businesses.

An official from a commercial bank criticized, “Even though the ruling party regulates international standards such as BIS and urges investment ahead of the election, the government should take the center, but the role of the financial authorities is not seen now.”

“If the political power or the government intervenes in the management of financial companies from time to time, financial companies will eventually become dependent on the government like public enterprises,” said Lee Young, a professor at Hanyang University’s Department of Economics and Finance. “If fiscal soundness is broken, it will eventually lead to inefficiencies that the government has to pay taxes, and the damage will be passed on to consumers.”

Reporter Jiyu Hong [email protected]