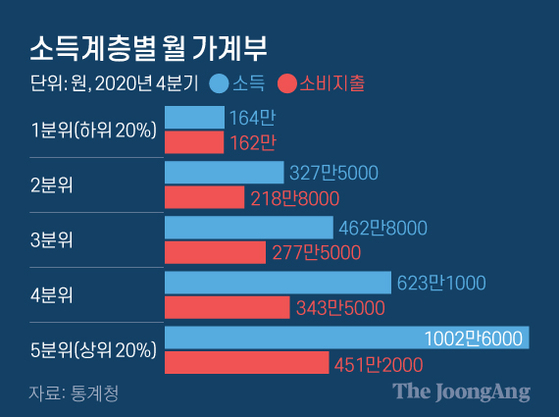

Monthly household account book by income class. Graphic = Reporter Kim Young-ok [email protected]

The aftermath of the novel coronavirus infection (Corona 19) was toxic to the living of low-income families. However, even the high-income class enjoyed the benefits of the disaster subsidies provided by the government last year. As a result, the income gap has worsened.

On the 18th, the National Statistical Office announced the results of the ‘4th quarter 2020 household trend survey’. According to the survey, the average monthly income per household (two or more) in the fourth quarter of last year was 5.16 million won. It increased by 1.8% compared to the same period last year. Expenditure decreased by 0.1% to 3892,000 won.

The appearance of the household account book is not bad, but it festered when opened. In the fourth quarter of last year, both earned income (-0.5%) and business income (-5.1%) decreased compared to the same period last year. This is the largest decline ever since 2003, when statistics were started. On the other hand, extraordinary income (49.1%), including transfer income (25.1%), such as pension and disaster support, and retirement allowances due to unemployment, increased significantly. Shin Se-don, a professor of economics at Sookmyung Women’s University, said, “I was relieved of hunger because of the fish caught in the country (transfer income), not the fish I caught myself (earned income).”

The top 20% of the income earned 4.72 times the bottom 20%. Graphic = Kim Eun-kyo [email protected]

It was low-income people who were hit directly by Corona 19. The average monthly income of households in the first quintile (lower 20% of income) was 1.64 million won, an increase of 1.7% in a year. During the same period, household income in the fifth quintile (the lower 20% of income) rose 2.7% to 1,020,000 won. The’quintile factor’, an indicator of the income gap, was 4.72 times, worse than the same period last year (4.64 times). The quintile multiplier is the disposable income of the quintile household (money that can be actually spent excluding taxes and interest) divided by the disposable income of the household in the first quintile.

In particular, the impact of the’job disaster’ was concentrated on the low-income class. Earned income for the first quintile decreased by 13.2% and the second quintile decreased by 5.6%, while the fifth quintile increased by 1.8%. It is thanks to transfer income that reduced the extent of the decline in income for low-income families. Income before the first quintile was 737,000 won, accounting for about half of the total income.

Disaster subsidies paid over the first to third rounds also filled the pockets of high-income families. The increase in transfer income increased significantly in the 3rd quartile (19.7%), the quartile (45.5%), and the 5th quintile (36.3%) than in the first quartile (16.5%) and second quintile (15.9%). “The average number of household members in the 1st quintile is 2.43, and the 5th quartile is 3.46,” said Jeong Gu-hyeon, head of the Household Accounting Trends at Statistics Korea.

Disaster subsidies are not free. The monthly mandatory money (non-consumption expenditure) paid by the people, such as taxes, national pension and health insurance premiums, was 986,000 won, approaching 1 million won. As the government expands its finances for income-led growth, there is a trend of increasing the amount of money collected for various purposes. Kang Seong-jin, a professor of economics at Korea University, pointed out, “It is the role of the government to fill in the inevitably reduced income with disaster subsidies, but it has not been able to properly distribute the fruits to the victims who were directly hit by Corona 19.”

Looking at the spending, the shadow of the’recession-type surplus’ was prominent. Considering disposable income of 100, the average propensity to consume, which means the amount of consumption expenditure, fell 1.7 percentage points to 69.6%. It means you have closed your wallet. Food and beverages (16.9%), household goods and housekeeping services (15.6%) increased due to the Corona 19’Zipcock’ effect, while clothing and shoes (-9.2%), entertainment and culture (-18.7%), and education (-15.2%) %) and so on.

Sejong = Reporter Kihwan Kim [email protected]