Kim Mo (38), an office worker whose hobby was to go to a traditional market near his home every weekend, has increased online shopping since last year. Since orders are delivered to your home in no time, the number of people buying food and industrial products only online has increased without going to the market these days. Kim said, “I added fun to buying clothes and cosmetics with a smartphone shopping app during commute hours.”

The phenomenon of’Retail Apocalypse’, which means the decline of the offline retail industry, is accelerating. It is analyzed as the aftermath of the rapid increase in consumption of’untact (non-face-to-face)’ due to the spread of the novel coronavirus infection (Corona 19), while the restructuring of offline retail stores has been underway for several years.

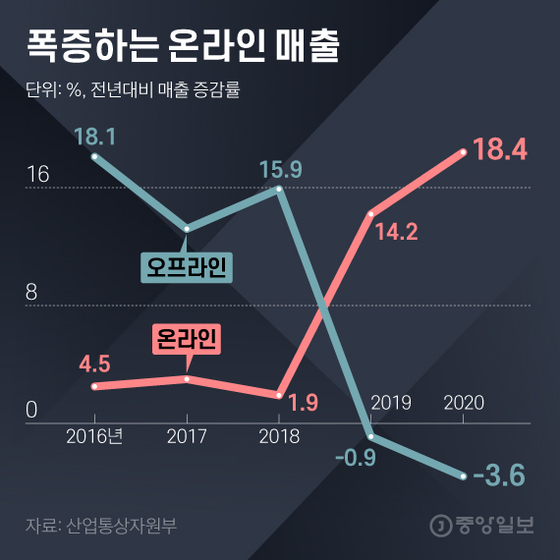

Online sales exploding. Graphic = Younghee Kim [email protected]

According to the Ministry of Trade, Industry and Energy on the 8th, sales of offline companies such as hypermarkets, department stores, and enterprise supermarkets (SSM) accounted for 53.5% of the total sales in the distribution industry last year. This is a decrease of more than 5 percentage points from the previous year (58.8%). During the same period, the share of sales of online companies such as Coupang, WeMef, Ticon, 11th Street, Interpark, G Market, Auction, E-Mart, Shinsegae Mall, and Lotteon increased from 41.2% to 46.5%.

Online sales increased by 18.4% compared to the previous year. In particular, online sales surged 34.3%, 20.1%, and 27.2%, respectively, in February, August, and December, when the level of social distancing was raised due to the corona 19 pandemic. On the other hand, offline sales fell 3.6%, recording negative for the second consecutive year. Department stores such as Lotte, Hyundai, and Shinsegae Department Store saw a significant decrease in sales (-9.9%).

Market research firm Consumer Insight’s analysis is similar. The share of offline shopping spending from 42% in July 2019 fell to 37.8% in November last year. Accordingly, the gap in the proportion of on-line spending widened from 16 percentage points to 24.4 percentage points over the same period. “As the social distancing period prolonged last year, we were affected by refraining from going out and avoiding multi-use facilities,” said Kim Ho-sung, head of the distribution and logistics division of the Ministry of Industry. “As a result of the spread of consumption culture that emphasizes immediate convenience and convenience, and online and non-face-to-face consumption.” Analyzed.

Off-line stores that are closing are also increasing. Lotte Shopping, which closed 114 stores in the past 10 months, has only 100 stores planned to close this year. E-Mart and Homeplus have also started shrinking stores. It is not limited to large retailers. Cosmetics, clothing, and food outlets are also closing.

Source: Korea Real Estate Agency

Accordingly, the vacancy rate continues to rise in major offline commercial areas such as Myeong-dong and Apgujeong in Seoul. Gwanghwamun (the vacancy rate of medium and large shopping malls), a representative office cluster, rose from 4% in the fourth quarter of 2019 to 15.3% in the fourth quarter of last year. Sungshin Women’s University, a college student, also jumped from 5.6% to 14.5% during the same period. The same is true of Gangnam-daero (5.2% → 8.7%) and Apgujeong (7.2% → 12.8%), the core commercial districts of Gangnam.

Usually in popular commercial districts, other stores are immediately opened in closed positions, but as there are many offline stores that are closed, it is interpreted that vacancy is increasing.

The fact that ‘5060’ middle-aged customers, who were highly dependent on offline stores such as marts and department stores, emerged as the’big hand’ of online distribution is also fueling this phenomenon. It means that the number of 5060 generations who expanded their footsteps to the digital shopping world beyond offline shopping has increased. In fact, the proportion of mobile payment customers in their 50s and 60s continues to increase in major online shopping malls.

Song Mo, 62, who recently moved, bought a refrigerator and washing machine for a new home at an online shopping mall. After looking at products at an offline store near my house, I bought a model I liked online. Song said, “There seems to be no difference in quality,” he said. “Online is cheaper, and it is more profitable because you can accumulate various points.”

Source: Samjung KPMG

This phenomenon does not only appear in Korea. According to’The Beginning of a Great Distribution, Retail Apocalypse’ published by Samjung KPMG, from 2017, large US retail companies closed many offline stores and filed for bankruptcy protection. Many of America’s leading retail companies, including ToysRus, Sears, Neiman Marcus, and JCPenney, filed for bankruptcy protection in the U.S. federal court. Accordingly, the term’retail apocalypse’ began to be used in the US media.

“Retail apocalypse is a global phenomenon that emerged from the start of the 4th Industrial Revolution in 2008,” said Seo Yong-gu, a professor of business administration at Sookmyung Women’s University. “It is inevitable that the decline of offline retail stores that digital natives familiar with smart phone shopping do not find.” All. He continued, “The delivery industry that dominates consumer lifestyles, like Amazon, is the direction the retail industry should go in the future.” Sustainable growth is possible only by converging food, clothing, healthcare, and content and creating a new success equation that provides personalized services. I advised.

Sejong = Reporter Son Hae-yong and Kim Ki-hwan [email protected]