Grade 1-10, subdivided into 1-1000 points

“Expectation to improve financial accessibility for low-credit groups”

[서울파이낸스 김현경 기자] From next year, the personal credit rating system will change from the rating system to the score system. Although the credit ratings were similar, the practice of receiving disadvantages during loan review due to different credit ratings is expected to improve, thereby enhancing financial accessibility for low-credit groups.

The Financial Services Commission announced on the 27th that the credit score system will be implemented in all financial sectors from January 1st next year. Previously, individual credit ratings were evaluated by dividing them into 1-10 grades, but in the future, they will be evaluated with a credit score of 1 to 1000 points.

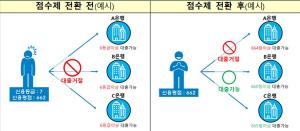

Although the existing credit rating system had similar credit ratings, it was pointed out that loans were uniformly rejected according to the rating. For example, there were cases where a person with a credit score of 7th grade and a person with a lower 6th grade had similar credit ratings, but those with a 7th grade were disadvantaged at the time of loan review. To improve this, a score system was introduced rather than a rating system.

Previously, five commercial banks, including KB Kookmin, Shinhan, Hana, Woori, and NH Nonghyup, have applied the credit score system on a trial basis since January last year to minimize market confusion. Afterwards, the credit score system was fully introduced in all financial sectors from January 1st of next year after revision of related laws and regulations.

In the future, personal credit rating companies (CB) do not calculate credit ratings, but only calculate personal credit scores and provide them to financial consumers and financial companies. However, corporate (individual business) credit rating, financial company internal credit rating, etc. can be used in the same way as before.

Financial consumers can manage their credit rating by using the credit score and accumulated rankings provided by CB companies, and customized credit management tips. The Financial Services Commission predicted that the introduction of detailed loan screening criteria by financial companies would not uniformly reject loans according to credit ratings, and would improve financial accessibility for low-credit financial consumers.

In addition, credit rating standards in laws related to card issuance and support for low-income financial products will also be changed to the individual credit rating standards. If the credit card issuance standard was previously 6th grade or higher, it will be changed to 680 points or higher for nice evaluation information or 576 points or higher for KCB from next year. Also, the target of support for low-income financial products such as Sunshine Loan will be changed from below 6th grade to below 744 points of nice evaluation information or below 700 points of KCB. In case of mid-interest rate loans, the preferential criterion for the credit limit will be changed to 859 points or less for nice evaluation information or 820 points for KCB or less from the existing 4th grade or lower.

The Financial Services Commission said, “We will closely monitor the status of the credit score system conversion to support the stable settlement of the credit score system,” and said, “Financial companies and financial institutions in accordance with the conversion of the score system, such as operating a quick response team in cooperation with the Financial Supervisory Service, CB companies, and associations, We will respond immediately to the occurrence of difficulties from consumers,” he said.

Copyright © Seoul Finance Unauthorized reproduction and redistribution prohibited