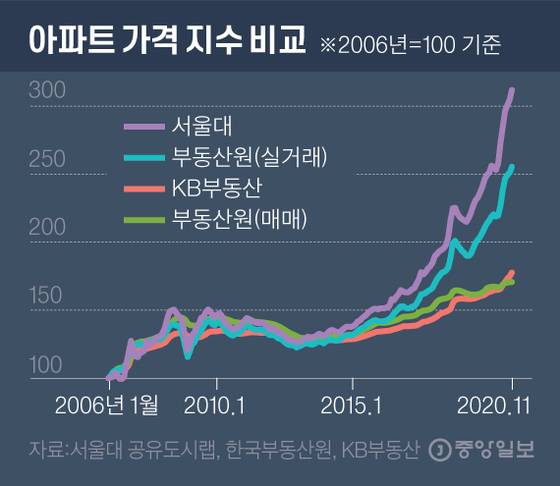

As a result of an analysis by the research team at Seoul National University’s Graduate School of Environment’s Shared City Lab, the price of apartments in Seoul has risen 83.9% over the past four years since the Moon Jae-in administration’s inception in 2017.

Analysis of 10 million actual transactions of Seoul National University Shared City Lab

Price increase rate, as much as 5 times more than government announcement

The price index should also reflect qualitative differences such as area, building, and floor.

The’Apartment Actual Transaction Price Index’ provided to the JoongAng Ilbo on the 22nd by a research team at the Graduate School of Environment Kim Kyung-min used a hedonic housing price determination model for more than 10 million actual apartment transactions nationwide from 2006 to last November released by the Ministry of Land, Infrastructure and Transport This is the result of the analysis based on it. This research team is applying AI artificial neural network (deep learning) technology to analyze and utilize price index.

Apartment price index comparison. Graphic = Reporter Kim Young-ok [email protected]

According to this data, apartment prices in Seoul have risen 173.1% since 2006, and 83.9% since May 2017, when President Moon took office. It is a number that differs by as much as five times or more from the rate of increase in apartment prices disclosed by the Moon Jae-in administration.

The Korea Real Estate Agency under the Ministry of Land, Infrastructure and Transport publishes two types of apartment price indices every month. It is a trading price index created by a sample survey method and an actual trading price index analyzed based on the actual transaction price data of the Ministry of Land, Infrastructure and Transport.

According to the Korea Real Estate Agency, the trading price index rose 16.6% and the actual transaction index 64.9% until last November after the Moon Jae-in administration was launched. In July of last year, former Minister of Land, Infrastructure and Transport Kim Hyun-mi said, “(For Moon Jae-in government) house prices in Seoul rose by 11% and apartment prices by 14%.” The apartment price index released by KB Real Estate of Kookmin Bank rose 29.6% over the same period.

Moon Jae-in administration Seoul apartment increase rate Graphic = Reporter Kim Joo-won [email protected]

Moon Jae-in Administration Apartment price increase rate by metropolitan area. Graphic = Reporter Cha Junhong [email protected]

The reason why the analysis results differ for each price index published by each institution is because the statistical models applied are different. The KB Real Estate Index with little fluctuation in the index and the real estate agent’s sale price index compare the fluctuations of the sample houses based on the survey price (ask price) of the surveyor (authorized broker, etc.) Price estimation is possible even if no actual transaction occurs.

As of last year, the sample housing for which the Korea Real Estate Agency calculates the monthly apartment price index is 17,190 households, and 9,400 households per week. The sample number of KB Real Estate is 35,000 households per month and 31,000 per week. This is why there is a difference between the two indices. Controversy continued that the real estate agent sales price index “is it intentionally reduced and announced to cover the rise in house prices”, and the dated real estate agent said, “The number of apartment samples is 32,000 households in the case of a weekly survey and 35,000 households per month. “I plan to increase it to” he said.

However, Professor Kim Gyeong-min said, “It is not a problem to be solved by increasing the number of samples. An index based on the survey price is not suitable for analyzing the actual price fluctuation.” It is less sensitive than the price fluctuations of the company.

The rate of increase in apartment prices by previous government. Graphic = Reporter Cha Junhong [email protected]

The Real Estate Agency’s real transaction index is calculated from the price change rate and transaction volume of the same house in which the actual transaction report occurred more than twice during the index calculation period. It can be measured with relatively little data, and because it uses real transaction data, it reacts sensitively to price changes. However, this analysis method also has limitations in reflecting qualitative differences such as the area, building, and floor of an apartment. Professor Kim also said, “Among the apartment price indexes that are released regularly, the real estate agent’s actual transaction price index is relatively accurate.”

On the other hand, the price index of the Seoul National University research team is based on the hedonic pricing model widely used in other fields. The hedonic model calculates the real value of an apartment by considering the location, number of floors, size, and direction. The research team at Seoul National University fully analyzed the actual transactions of all apartments, not samples (samples), and improved the accuracy of the index by reflecting qualitative changes.

Case Schiller, a professor at Yale University, who created this index by a method used in the calculation of the’Standard & Poor Home Price Index’ in the United States, received the Nobel Prize in Economics in 2013. The hedonic model has been recognized for its accuracy and is widely used not only in real estate but also in price analysis studies, but the government has not applied it to calculating the real estate price index.

Kyungmin Kim Professor, Graduate School of Environmental Studies, Seoul National University

Professor Kim Gyeong-min emphasized that “a precise house price index approved by the government is necessary.” Professor Kim majored in urban planning and real estate at Harvard Graduate School, and is currently a real estate expert who leads the Seoul National University Shared City Lab.

Professor Kim said, “When a price index that properly reflects reality comes out, various analyzes can be performed based on it. For example, financial derivatives linked to the housing price index can be created, and proptech industry using real estate big data also has It can be helpful,” he said. Professor Kim’s research team also created a model to evaluate the value of individual apartments by analyzing the apartment price index using an artificial neural network. The appropriate price for a specific apartment complex in a specific area can be calculated through AI analysis.

Reporter Kim Won [email protected]