“Focus on spreading the warmth of inclusive finance”

[아시아경제 박선미 기자] Financial authorities will expand’inclusive finance’ by reviewing the width of the Sunshine Loan 17 rate cut in line with the maximum rate cut, and temporarily supplying loan products with loans exceeding 20%.

On the 14th, the Financial Services Commission said that it will make various efforts to spread the warmth of inclusive finance by making it a key task for the financial consumer sector this year to reduce the burden of high interest rates and strengthen customized support for the vulnerable through follow-up measures to lower the highest interest rate. Revealed.

In line with the maximum interest rate cut (24% → 20%, scheduled to be implemented in early July), the Sunshine Loan 17 rate cut will be reviewed during the second half of this year, and loans exceeding 20% will be temporarily supplied. For example, a maximum of 20 million won is supported for loans for the purpose of repayment to low-income and low-credit users who have been using high-interest rate loans in excess of 20% for more than one year prior to the effective date of the maximum interest rate cut, or those who have been using a loan with a high interest rate exceeding 20% for more than one year, or who have a maturity of less than six months and are repaying normally.

In addition, it plans to diversify policy-less financial products by supporting individual financial sectors to lead the way in designing and supplying policy-friendly products, rather than a uniform supply focused on workers’ sunshine loans. Incentive support for financial companies with excellent low-income loans will also be considered. In this process, to eradicate illegal private finance Prosecutors, police officers, and special envoys will conduct a strict crackdown, and strict penalties will be handled, such as depriving the gains of tax evasion through tax verification and investigation. Appointment of a debtor’s representative to block illegal collection, and support for attorneys for lawsuits for returning interest in excess of the maximum interest rate will be expanded and strengthened.

Introduction of an ultra-long raising mortgage for young people

In order to spread the warmth of inclusive finance, customized support for the vulnerable will also be strengthened.

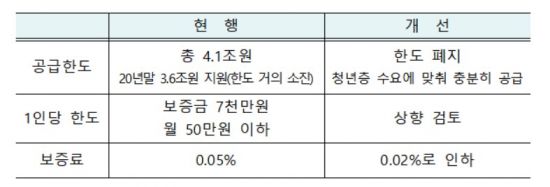

The plan is to lower housing finance costs for young people by introducing an ultra-long mortgage for young people and expanding support for rent to cheonsei. A mortgage loan with a maturity of up to 40 years for young and newlyweds will be first introduced into the policy mortgage to reduce the burden of repayment of principal and interest paid monthly. During the first half of the year, we will provide enough products to support deposits and monthly rent to young people at an interest rate of 2%, and increase support for monthly loans, such as lowering the guarantee fee from the current 0.05% to 0.02%.

Support is also provided to relieve the excessive burden of vulnerable debtors and to recover quickly.

In the case of business closures or closures due to Corona 19, regardless of their business history, they can apply for a special repayment deferral (maximum 2 years) before debt adjustment amortization, and advance debt adjustment (interest rate adjustment) for individual debtors with a delinquency period of 31 to 89 days. It plans to improve in a way that helps the vulnerable. By promoting the enactment of the Consumer Credit Act (to be submitted to the National Assembly in the first half), a fair debt adjustment infrastructure between creditor financial institutions and individual debtors is planned.

It also supports the early settlement of the Financial Consumer Protection Act. While the Financial Consumer Protection Act (Money Soo Act) comes into effect on March 25, the Financial Services Commission plans to quickly respond to difficulties in the field by intensively operating the Financial Consumer Law Enforcement Preparation Situation Group for three months before and after the enforcement of the law.

Reporter Park Seon-mi [email protected]