(Seoul = Yonhap News) Reporter Seong Seo-ho = The amount of money on the market in January increased to the highest ever due to the influence of the expansion of credit supply to the private sector.

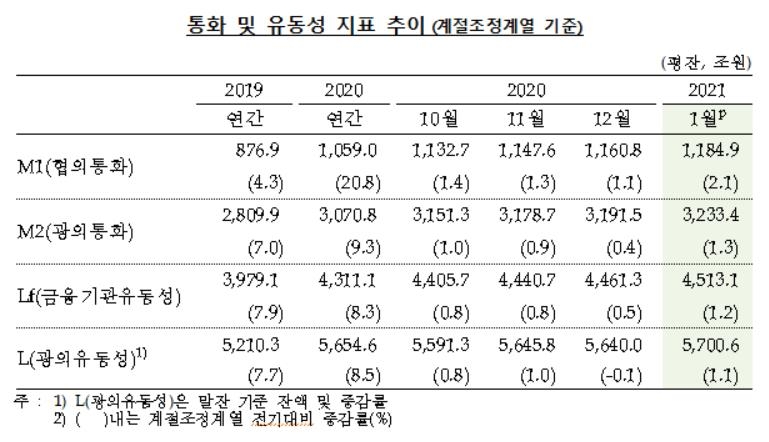

According to the Bank of Korea’s currency and liquidity statistics on the 18th, in January this year, the amount of money in broad terms (based on M2) was 3233 trillion won, an increase of 41 trillion won (1.3%) from December last year.

The increase in January is the largest since the statistics were compiled in December 2001.

In the broad sense of the monetary volume index M2, cash, demand deposit, occasional deposit (more than M1), MMF (Money Market Fund), periodic deposit less than 2 years, savings account, beneficiary certificates, CD (transferable deposit certificate), RP (repurchase conditional) Bonds), financial bonds less than 2 years, money trusts less than 2 years, and short-term financial products that can be converted into cash immediately.

Compared to the previous month, the increase rate not only expanded from December last year (0.4%), but also compared to the previous year (10.1%), the increase rate (10.1%) increased from a month ago (9.8%). The 10.1% increase rate is the highest since October 2009 (10.5%).

Businesses increased by 24 trillion won, and M2 increased in all economic entities, including households and non-profit organizations (4.7 trillion won), other financial institutions (4.5 trillion won), and other sectors (1.2 trillion won).

In particular, the growth of companies (24 trillion won) is the largest ever. The BOK explained that the company’s efforts to secure liquidity led to the inflow of funds to bonds, stock-type beneficiary certificates, and regular deposits and savings accounts for less than two years.

By product, occasional deposits (15.3 trillion won) and MMF (7.2 trillion won) have increased.

![[한국은행 제공. 재판매 및 DB 금지]](https://i0.wp.com/img0.yna.co.kr/etc/inner/KR/2021/03/18/AKR20210318066800002_01_i_P4.jpg?w=560&ssl=1)

[한국은행 제공. 재판매 및 DB 금지]

Unauthorized reproduction-redistribution prohibited

2021/03/18 12:00 sent