The’fire’ surrounding the 4th emergency disaster subsidy has shifted to the Treasury Bond interest rate. To prepare the budget, additional large government bonds must be issued. As the market increases the supply of government bonds, government bond prices fall and interest rates rise.

To prepare a budget, government bonds must be issued

Increase in supply, price decline, interest rate rise

Deficit government bonds likely to exceed 100 trillion won this year

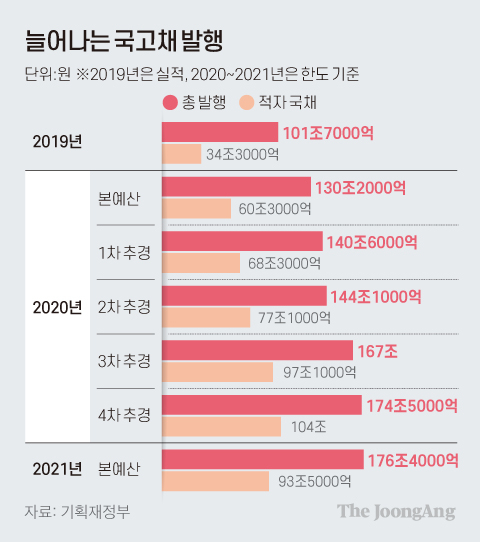

Increasing government bond issuance. Graphic = Reporter Cha Junhong [email protected]

According to the Financial Investment Association on the 16th, the 3-year treasury bond rate, which is an indicator of the market rate, ended at 0.984% per year. It fell from the previous day (0.998% per year), but rose by 0.048 percentage points from the 5th of last month (0.936% per year), which was the lowest of the year. The 30-year treasury bond rate ended at 1.994% per year on the 16th. On the 15th, it jumped to 2.012% per year. It rose 0.192 percentage points from the 11th of last month (1.802% per year), which was the lowest of the year. The 10-year Treasury bond rate was 1.85% per year on the 16th, up 0.159 percentage points compared to the year-round low (1.691% per year).

Although the real economy is still sluggish, the interest rate of government bonds traded in the market has recovered to the level before the Bank of Korea lowered its benchmark interest rate from 0.75% a year to 0.5% a year in May last year. Inflation warning lights are lit in the US as well, and long-term government bond yields are on the rise.

Deputy Prime Minister Hong Nam-ki and Minister of Strategy and Finance said that most of the 4th disaster support fund would have to be covered by the issuance of deficit government bonds. The government and the ruling party have not yet decided on the size of the additional budget. Various numbers, ranging from 10 trillion won to 30 trillion won, flow from inside and outside the government and ruling party.

Treasury bond rates rising. Graphic = Reporter Cha Junhong [email protected]

Based on this year’s budget, the limit for issuance of deficit government bonds is 93 trillion won. In order to provide the 4th disaster subsidy as an additional budget, the deficit government bonds this year have to exceed 100 trillion won. Goo Hye-young, a researcher at Mirae Asset Daewoo, said, “The 4th disaster subsidy was agreed in a way of’pre-customized support and post-universal support’, but uncertainty about the scale of selective payment remains.” He added, “It will be reflected as uncertainty about the size of the issuance of deficit government bonds, which will lower the investment attractiveness of government bonds.”

Last year, the Ministry of Knowledge Economy issued 17.75 trillion won worth of government bonds. In this budget, it was expected to be 13,200 trillion won, but the scale of issuance of government bonds increased significantly after the first to fourth rounds of supplementation. In the aftermath of the novel coronavirus infection (Corona 19), the quarantine budget was increased and disaster support was paid three times. Of this, 104 trillion won was a deficit government bond. When issued, it is a bond that is taken as a debt.

Sejong = Reporter Cho Hyun-sook [email protected]