|

As virtual asset (cryptocurrency) investment is gaining popularity, real-name virtual account applications are rapidly increasing. In particular, K-Bank, an internet-specialized bank that has partnered with Upbit, the number one virtual asset exchange in Korea, has recently met an unexpected favourite called’Bitcoin Rally’ and is winning and winning.

Virtual account banks that make money are reluctant

It is reported that K-Bank’s total accounts exceeded 3.2 million thanks to the surge in accounts linked to Upbit, and the balance of deposits and savings in February last month increased by 2.4 trillion won. In a month, more than 50% of the total receiving balance of K-Bank has increased.

There are only three places that have created deposit and withdrawal accounts linked to the Virtual Asset Exchange: K Bank, NH Nonghyup Bank, and Shinhan Bank. Why aren’t other banks offering virtual account services?

|

|

Banks said it was difficult to open a virtual account because of the financial authorities’ notice. A bank official said, “It is difficult to open a deposit/withdrawal account because the financial authorities are not aware of virtual assets so well.” A bank official who has a real-name account linked to the Virtual Asset Exchange also pointed out that “even if the revised Specific Financial Information Act (Special Law) is enforced on the 25th, the relationship between the financial sector and the Virtual Asset Exchange is inevitable because a detailed checklist is not available. .

When the special money law is enforced, the exchange must secure a real-name bank account. As the probation period for enforcement of the revised law is six months, it is necessary to sign a contract with the bank until September at the latest, and banks are forced to judge the reliability of the virtual asset exchange entirely without specific guidance from the financial authorities.

Issuing a real name account is entirely determined by the bank Government irresponsibility

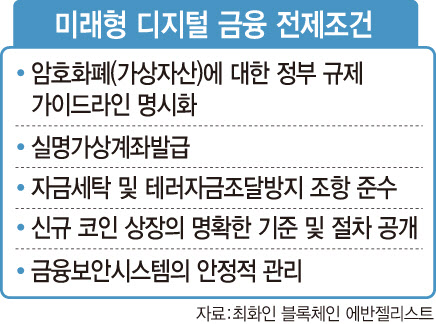

At the’International Business and Finance Conference (IBFC)’ held at the Haevichi Hotel & Resort in Seogwipo-si, Jeju-do hosted by E-Daily on the 18th, Choi Hwa-in Blockchain Evangelist said, “One thing that has changed with the special money law is that you have to create a real-name virtual account. “It was based on a good judgment.”

Currently, only four domestic virtual asset exchanges have real-name accounts: Bithumb, Upbit, Coinone, and Corbit. If the rest of the exchanges cannot secure real-name accounts, there is a possibility that they will be eliminated from the market.

Evangelist Choi said, “As the most common money laundering in the world does not block cash or cash transactions, it is necessary to prevent money laundering using cryptocurrency, but to some extent it is difficult to completely block 100% of money laundering.”

A bigger problem is that there is no countermeasure under the Special Privilege Act, such as disclosure of clear standards or procedures for listing new coins to prevent listing of fraudulent coins.

He said, “There is only money laundering prevention under the Special Act, there is no consumer protection for fraudulent coins, and there is no intention to promote digital business rights.” There are not a lot of homework to be solved, such as whether to see it. He advised, “We need to hurry to reorganize the system to go to future digital finance.