Competition for open banking in the second financial sector

According to the financial sector on the 23rd, mutual financial institutions such as the Saemaul Geumgo Federation, the Korea Federation of Credit Unions, the Korea Forestry Cooperative Federation, and the Post Office (post office) were added to financial institutions that can register for open banking. The NACF can be used from the 29th of this month due to the outbreak of corona19.

|

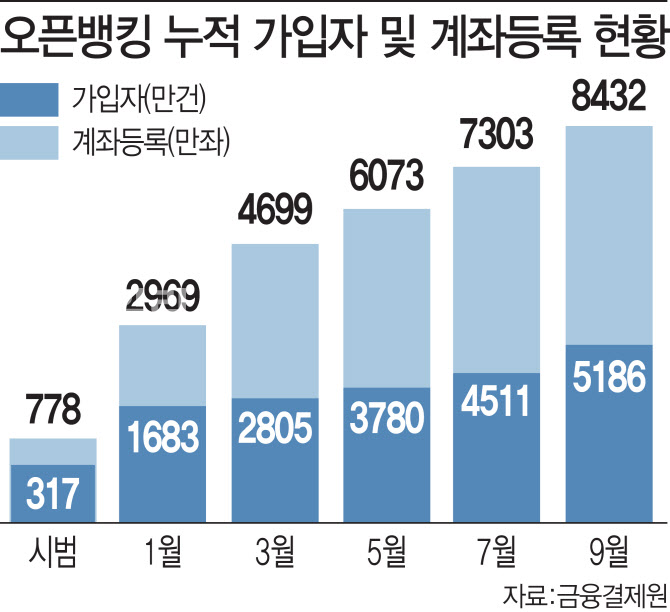

Open banking is a service that allows other financial companies or third-party service providers to access financial information of customers held by financial companies. This allows consumers to register all their bank accounts with one financial company app, view and transfer them at a glance. It is a service that can attract customers who use other financial companies. The open banking service was officially launched on December 18 last year, and the number of subscribers increased from 16.83 million in January this year to 51.86 million as of the end of September. The number of subscribers is expected to increase further with the introduction of open banking services in the mutual financial sector.

Mutual financial companies, which introduced the open banking service from the 22nd, began to drive customers with fee exemption benefits and new products.

The post office is an event that completely exempts Internet, mobile, phone banking, and ATM transfer fees from customers who have subscribed to Open Banking, and offers prizes to customers who have registered accounts held by other banks. The credit union is also holding a transfer fee exemption and a giveaway event for subscribers until March next year.

Earlier, Saemaul Geumgo launched’Honey Card’ with discounts on Netflix, YouTube usage fees and delivery apps, and simple payments to secure younger customers with high use of open banking, and participated in the’Good Renters Movement’ and It also launched the’MG Good Neighbors Regular Payment’, which can receive a preferential interest rate of up to 5.5% per year.

An official from Saemaul Geumgo said, “We will try to increase the use of open banking to the previous generation while upgrading the smartphone banking system.”

With high interest rates ahead, savings banks are coming soon.

Savings bank, a latecomer, is also at the end of its introduction of open banking services. The savings bank is expected to introduce services in April next year.

The National Savings Banks Association signed a contract with a system building company in October and started building an open banking platform. Savings banks will participate in open banking through SB Talk Talk Plus of the National Savings Banks Association. SB Talk Talk Plus is a common mobile banking app in the industry. The Korea Federation of Savings Banks believes that it will take about 4 months to build, and it aims to introduce it in April after the first opening in March of next year, and after a stabilization period.

2 Financial sectors are expected to increase customer accessibility with the introduction of open banking. It is calculated that the advantages such as high preliminary interest rates are highlighted and customers can be secured.

Currently, the interest rates on deposits and savings of mutual finance and savings banks are higher than those of commercial banks. In fact, the deposit rates of four major commercial banks (12 months) are at 0.5-0.9%, while the average interest rate for term deposits of savings banks is 1.91% (12 months), and mutual banking is 1.6-1.7%, which is more than 1 percentage point with commercial banks. It makes a difference.

As the low interest rate trend intensified this year, consumers who are sensitive to interest rates have already left banks and moved funds to the second financial sector. According to the Bank of Korea, the savings bank’s September receipt balance was 72,825.8 billion won, up 15% from the same period last year (63,292 billion won).

An official from the mutual finance industry said, “With the introduction of open banking services, it is true that the frequency of exposure of our products to consumers has increased, and as a result, the room for customers to move has increased.” “With open banking, mobile apps are easy to use. “I think there will be quite a lot of movement of young customers, the main producers,” he said. “However, since commercial banks have already occupied the market, I do not know how much mutual finance or savings banks will be able to attract customers,” he said. “It is unknown how useful it will be compared to the usage fees paid to the KFTC.” .