Financial companies are required to report to the Financial Information Analysis Agency (FIU) within three business days from the time they decide to target a suspicious money laundering transaction.

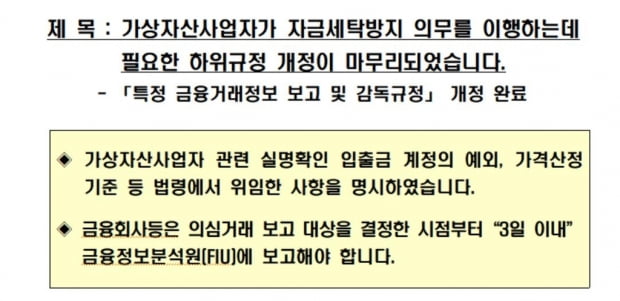

The Financial Services Commission announced on the 22nd that it has finished revising the’Specific Financial Transaction Information Reporting and Supervision Regulations’ with these details.

The amendment made it clear that the person in charge of reporting on anti-money laundering, such as a financial company, should report’within 3 business days from the time when a financial transaction subject to reporting suspicious transactions is decided.’

The current law only stipulated the timing of reporting suspicious transactions as’without delay’.

The revised rule also included the method of calculating the price of virtual assets (cryptocurrency) and exceptions to the real name verification account of virtual asset business operators.

At the time of trading/exchange of virtual assets, the virtual asset business operator calculates the amount in Korean won by applying the value of the virtual asset.

When a customer requests to transfer a virtual asset, the amount converted into KRW must be calculated.

An exception to the reason that virtual asset business operators do not have to issue a real name confirmation deposit/withdrawal account is a “virtual asset business operator that does not exchange money with virtual assets.”

The Specific Financial Information Act, which takes effect on the 25th of this month, requires virtual asset operators to use real-name accounts, but virtual asset operators that do not deal with the exchange service between virtual currency and money are not subject to this obligation.

A virtual asset business operator can mediate the trading and exchange of virtual assets between its customers and other business customers only when certain requirements are met.

Other virtual asset providers must be licensed domestically or overseas, and must be able to check the customer information of the counterpart virtual asset provider.

The handling of’Dark Coin’, which has a high risk of money laundering due to difficulty in understanding the transaction details, is prohibited.

/yunhap news

Ⓒ Hankyung.com prohibits unauthorized reproduction and redistribution