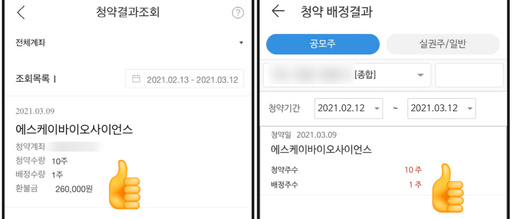

An online stock community post on the 12th. The netizen responded with cheers saying, “The subscription was successful.”

The online community is receiving attention as a series of certifications stating that the subscription to SK Bioscience has been successful has been posted one after another. Investors who became shareholders of SK Bioscience showed a mixed response as they could not receive a single share if they were unfortunate even if they subscribed.

On the 12th, a netizen using an online community said, “Successful subscription to SK Biopharm Science”, inquired and posted the result of his subscription. This post became popular, and there was a certificate of success in the subscription.

Another netizen said, “I took a total of 13 shares by using 5 securities companies,” and said, “It seems that it was effective to put in 30% more than the minimum margin by applying at various places.”

For this subscription, half of the total number of public offering shares was allocated in an equal manner. The allocation amount is evenly distributed to all subscribers. Unlike the existing method, which was distributed in proportion to the margin, it was expected that if you apply for the minimum subscription unit of 10 weeks, you will receive 1 share.

However, there were cases in which investors were crowded and received less than a week even if they subscribed. This is because the brokerage company, which had more subscription accounts than the equally allocated amount, was changed to a random lottery method. The securities companies are no longer able to allocate one share per case.

This was the case with Samsung Securities and Hana Financial Investment, which had a small allocation of 5%. The equal allocation of Samsung Securities and Hana Financial Investment was 14,5928 shares. However, 395,290 and 2,09594 subscriptions were received, respectively. In this case, the brokerage company conducts a random lottery to decide.

Still, at other securities companies, I was able to receive one to three weeks each. Dividing the proportional allocation of each securities company by the number of subscriptions is 1.66 shares of NH Investment & Securities, 1.21 shares of Korea Investment & Securities, 1.33 shares of Mirae Asset Daewoo and 2.07 shares of SK Securities. SK Securities can receive 2 weeks for SK Securities and 1 share for the remaining securities companies if subscriptions are made in a basic unit through these securities companies. Since then, there have been cases in which the remaining number of decimal points is drawn by a lottery for one more week.

Now, investors’ expectations are on whether to take a so-called’tasang’ (the upper limit on the first day of listing after the initial price is determined to be twice the public offering price). It is expected that it will be able to earn about 2.6 times more than the public offering price if it is recorded.

Meanwhile, all subscription margin refunds are made on the 12th. SK Bioscience’s listing on the stock market is on the 18th.