Input 2021.02.09 15:00

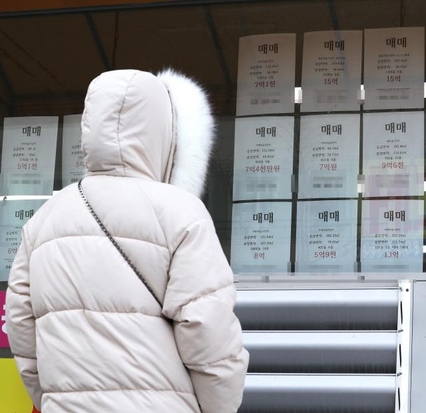

The real estate market in Gyeonggi Province, where the neighborhood rises when it is regulated, and the neighborhood rises again to match the keys, is turning around and getting hot in’Su, Yong, and Castle’. It is an analysis that the cycle has returned to the high-priced areas once the’key matching’ in the middle-low-priced areas such as Goyang, Gimpo, Paju, and Namyangju is finished.

In particular, all autonomous districts that are known as’first class’ in the region showed a weekly increase of 1%. Apartment prices in Bundang-gu, Seongnam, rose 1.13% each week, and Suji-gu, Yongin and Yeongtong-gu, Suwon also rose 1.09% and 1.0%, respectively.

In terms of the growth rate alone, it is not very different from the northern part of Gyeonggi Province, such as Goyang (1.36%), Uijeongbu (1.04%), and Namyangju (0.90%), but the acceptance is much larger as the basic price level is high. According to the Korea Real Estate Agency, the average price of apartment sales in Bundang-gu, Seongnam, exceeded 1 billion won last month, and Suwon Yeongtong-gu and Yongin Suji-gu also reached 64282 million won and 656.49 million won, respectively.

Reported transactions are also followed. The 84㎡ dedicated to’Pangyo Prugio Granble’ in Baekhyeon-dong, Bundang-gu, Gyeonggi-do, was traded at 2.410 billion won last month, up 200 million won compared to the previous transaction price. ‘Gwanggyo 2nd e-pyeonhansesang’ in Iui-dong, Yeongtong-gu, Suwon, and 84㎡ exclusively for’Raemian Suji East Park’ in Pungdeokcheon-dong, Suji-gu, Yongin recently joined the ‘1 billion club’.

Experts analyzed that the circulation market in the metropolitan area is returning to acceptance again. At the same time, they cited ▲ rising jeonse prices ▲ better accessibility to Gangnam ▲ strengthening direct access.

According to KB Kookmin Bank’s Liveon, in the second half of last year, the rental price of Gyeonggi apartments rose 7.17%. Suwon Yeongtong-gu (11.61%), Seongnam Bundang-gu (10.97%), and Yongin Suji-gu (9.19%) all significantly exceeded the Gyeonggi average. In addition, regions where the rate of increase in the total price exceeded 10% are in Gwangmyeong, Gwangju, Namyangju, and Gimpo. If the jeonse price rises steeply, it has the effect of boosting the trading price.

Professor Shim Gyo-eon of the Department of Real Estate at Konkuk University said, “In general, if the price of leased property rises rapidly, housing insecurity becomes severe and it turns to the demand for trading.” There is also an inflow of purchase,” he said.

‘Gangnam accessibility’, the biggest advantage of acceptability, is expected to improve. Suwon Station will be able to reach Gangnam in 20 minutes when the metropolitan metropolitan express train (GTX)-C and Yongin Station have GTX-A open. In addition, the Suin-Bundang Line and the Shin-Bundang Line are being extended. It is said that the favorable traffic conditions are a factor in the rise of trading prices.

“Sooyong-seong is an area that has developed with the advantage of commuting to Gangnam compared to some of the suburbs of Seoul,” said Ham Young-jin, director of Jikbang’s Big Data Lab. Expected.

The increase in direct access jobs’closer than Gangnam’ is also a factor. In the Seongnam High School District and Geumto District, the 2nd and 3rd Techno Valley in Pangyo is representative. It means that IT companies such as Kakao, Nexon, and NCsoft are already moving in, and’Korea’s Silicon Valley’, which has about 65,000 employees as of last year, will be bigger.

However, experts saw that the government’s supply measures could be a variable in the rise in acceptance. KB Kookmin Bank Senior Real Estate Expert Park Won-gap said, “Unless the jeonse crisis is resolved, it seems difficult to subside the water-acceptable buying trend, and the short-term stability effect will be limited with the 2·4 supply measures, which will be realized in the vague and distant future.” He said, “If the government really gives a’supply shock’ through additional policies such as the supply of new housing sites, I think that the soluble house prices may slow down.”