It is expected that the number of “naylon patients” who claim excessive insurance money than the degree of injury will decrease. The financial authorities are pursuing a plan to have their own insurance cover the treatment costs of minor injuries (injury grades 12-14) according to the negligence rate.

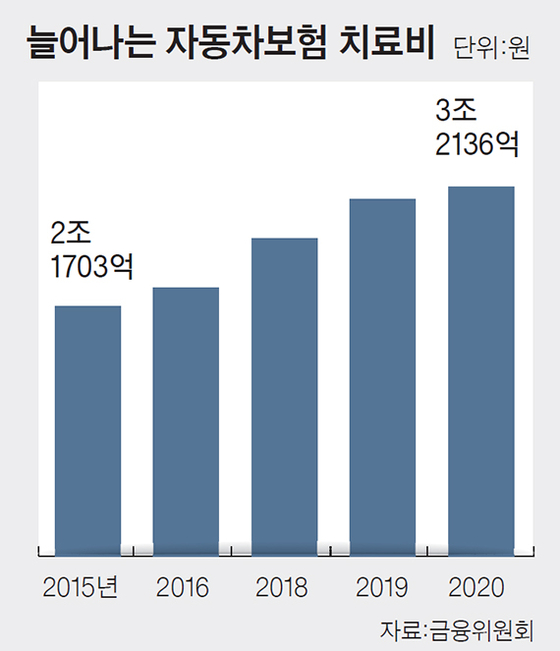

Car insurance treatment expenses soar 48% in 5 years

Financial Services Commission “reduce unnecessary medical treatment”

The Financial Services Commission announced on the 1st the’policy direction for trust and innovation in the insurance industry’ containing these details. Kwon Dae-young, head of the Financial Industry Bureau of the Financial Services Commission, said, “We will promote system improvement to reduce excessive medical care by allowing the person to treat their negligence with their own insurance, and to suppress the increase in automobile insurance premiums for the entire public.”

Increasing auto insurance treatment costs

Auto insurance can receive the full treatment cost from the other insurance company regardless of the negligence rate as long as the negligence rate is not 100% when an accident occurs. For example, suppose that the cost of treatment for the perpetrator A with a 90% negligence rate is 6 million won, and the treatment cost for the victim B with a 10% negligence rate is 500,000 won. In this case, the insurance company of B, which has a low percentage of negligence, compensates A with 6 million won, but the insurer of the perpetrator A compensates B with only 500,000 won.

As the Financial Services Commission pointed out that such a system encourages over-treatment, it decided to consider a plan to treat the negligence portion of the treatment cost for minor injuries with its own insurance (collateral for personal accidents). An official from the Financial Services Commission said, “If you are injured and charged excessively for treatment, your own insurance premium may be increased in the future, which may cause disadvantages, so unnecessary treatment will be significantly reduced. In compensation for property such as automobile repair costs, repair costs are already borne according to the negligence rate.

There is also a plan to make it mandatory to submit a medical certificate when a minor patient is treated beyond the normal treatment period. Currently, it is possible to receive treatment at a hospital for a long time with only subjective pain without objective evidence such as a medical certificate.

The reason the financial authorities have taken such measures is to block as much as possible the factors that raise premiums. Insurance per person for minor injuries was 1.79 million won last year, up 42% from 2016 (1.26 million won). The auto insurance treatment cost also increased from 2.17 trillion won in 2015 to 3.21 trillion won (48%) last year.

Financial authorities estimate that out of 3 trillion won in treatment expenses, 540 billion won is overdue treatment. This excess treatment will result in an additional burden of 23,000 won per insured person.

In addition, the financial authorities are also reviewing the current one-company, one-license deregulation. Currently, each financial group permits one life insurance company and one non-life insurance company. The aim is to ease this so that various insurance companies within a single financial group, such as an insurance company specializing in disease and pension insurance and a life insurance company specializing in simple insurance, will be able to operate specialized business for each customer and product, as in Japan.

Reporter Ahn Hyo-seong [email protected]

![]()