|

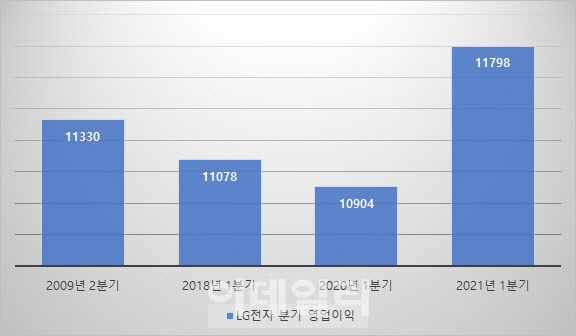

According to F&Guide, a financial information company on the 3rd, LG Electronics’ concession for the first quarter of this year, which will announce its tentative results on the 7th, recorded sales of 17,782.8 billion won and operating profit of 1,179 trillion won, showing 20.74% of sales and operating profit compared to the same period last year. Is expected to increase by 8.20%. LG Electronics’ record-breaking quarterly sales peak was 1.13 trillion won, which was recorded in the second quarter of 2009, when the mobile phone business peaked with’chocolate phones’. Since then, it has surpassed KRW 1 trillion in operating profit with KRW 1,107.8 billion in the first quarter of 2018 and KRW 1.90 trillion in the first quarter of 2020. As a result, if LG Electronics’ operating profit in the first quarter of this year meets the consensus, it will break a new record in 12 years.

In the industry, if the withdrawal of the MC division, which is in charge of LG Electronics’ smartphone business, is confirmed, the effect of improving performance is expected to be even greater.

It is known that LG Electronics will hold the board of directors on the 5th of the Arbor Day to decide whether to withdraw the MC business headquarters. The MC division has recorded a loss for 23 consecutive quarters since the second quarter of 2015, and the cumulative operating loss alone reached 5 trillion won. Initially, LG Electronics attempted to sell its MC business headquarters to several overseas companies such as Vietnam’s Vingroup, but it is said that it did not succeed.

When the withdrawal of the MC division is decided, LG Electronics’ annual operating profit is expected to jump to 4 trillion won.

LG Electronics’ target price has risen to the 220,000 won mark as the possibility of consignment production of Apple Car by Magna, which jointly established’LG Magna ePowertrain’ with the withdrawal of the MC business division, has increased. LG Electronics’ current share price is KRW 158,500 based on the closing price on the 2nd, and there is 38.8% upside potential up to the target price.

Kim Dong-won, a researcher at KB Securities, said, “It is estimated that LG Magna e-Powertrain will expand business due to the increased possibility of Magna’s consignment production of Apple cars.” “The reorganization of the MC division is expected to resolve uncertainties about the continuation of the deficit. As a surprise is expected, concerns about earnings will ease.”