Enter 2021.03.27 06:00

The purpose of enhancing the corporate value of business companies to be separated from SKT

OTT market ahead of Disney penetration after Netflix

App Market is Google, Commerce is Naver and Coupang’Lecture 2′

“Competitive front, which is not easy, the merger with SK is also a variable”

According to the telecommunications industry on the 27th, it is known that SK Telecom is actively considering a plan to separate it into a telecommunications business company (SK Telecom) and a non-telecom business company (intermediate holding company) through a split-off method. SK Telecom has only telecommunications business-related companies as subsidiaries like SK Broadband, and investment companies have SK hynix (000660)The plan is to deploy not only the same semiconductor company, but also new business-oriented subsidiaries such as One Store, Wave, 11st Street, and Wooti (a joint venture between T Map Mobility and Uber). In the long run, this investment company is also being debated on a merger with SK Corporation.

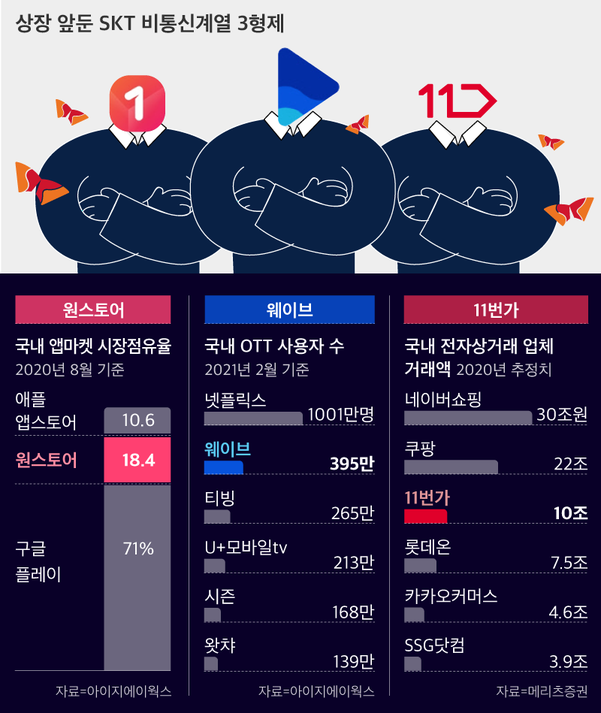

SK Telecom CEO Park Jung-ho said at the general shareholders’ meeting that although the scale is not large,’One Store’, which operates the native application (app) market, is almost ready to be listed. Starting with One Store this year, SK Telecom is preparing for an online video service (OTT) wave, and an IPO for e-commerce company 11st.

However, some point out that the external competitive environment of companies preparing to be listed is not favorable in the industry, so it will be difficult to significantly improve corporate value as expected by the company.

One Store, which will be the first to enter the IPO stage, has recently faced a major crisis with Google’s’half-price fee’ policy. In the meantime, One Store is on the way to growth by stealing some of Google’s share by offering relatively inexpensive payment fees (20%) and communication service linkage benefits compared to Google and Apple (30%), which are global app market operators that dominate and dominate the market. Came running.

As of August last year, One Store had 18.4% of the domestic app market market share. However, it is pointed out that the competitiveness has declined as Google announced that it will lower the payment fee for apps with digital goods from 30% to 15%, which is due to apply its own payment system from October. From the standpoint of app developers, there is no need to additionally enter the One Store, and in this case, consumers do not need to find a place with relatively few app types compared to Google.

Wave, which ranks second in the domestic OTT market after Netflix, the world’s strongest player, is also expected to have a difficult time in the future. As of February of this year, Netflix exceeded 10 million domestic users and is gaining popularity overwhelming Wave (3.95 million). In the second half of this year, another global OTT powerhouse, Disney Plus, is expected to land in Korea.

SK Telecom announced at the shareholders’ meeting that Wave is a competitive relationship with Disney Plus rather than a partnership relationship. At the same time, it also decided to increase the paid-in capital increase of 100 billion won to increase Wave’s own content capabilities. Wave plans to invest 1 trillion won by 2025, using this as a live ammunition. A media industry official said, “OTT’s core competitiveness is content, and it remains to be seen whether it can become a’competitor between Netflix and Disney’.”

It is unclear how competitive 11st will be given the low competitiveness of the open market and the domestic e-commerce market narrowing to the second power due to Naver Shopping and Coupang. 11th Street has announced plans to differentiate themselves in partnership with Amazon, but the details have not yet been materialized. SK Telecom is jumping into the acquisition of eBay Korea, another open market powerhouse that has recently been sold. The industry sees that it is unlikely to be completed.

The stock market has some outlooks that the corporate value of the business company may decrease depending on whether the business company separated from SK Telecom and SK Co., Ltd. will actually merge in the future. SK Group Chairman Choi Tae-won can carry out such a merger in order to increase its control over SK Hynix, which is a grand subsidiary through SK Telecom. Kim Hong-sik, a researcher at Hana Financial Investment, predicted, “In order for Chairman Choi to merge with the company while minimizing the dilution of the equity ratio, the market cap gap between SK Corp. and the business company must be wide, so it will be difficult for the business company to appreciate its value.”

Nam-Gon Choi, a researcher at Yuanta Securities, said, “Companies to be deployed as business companies through the reorganization of governance can raise the value of their book value through IPO, and most of them are currently at the’front line of competition’.” “It’s a nonsense assumption to be able to bring down the company’s growth.”