SK(244,000 +0.62%)Group affiliates showed the highest growth rate among group companies last year. This is because the portfolio was concentrated on rechargeable batteries, batteries, and bio, which was advantageous in the growth stock rally. However, as the market interest rate rises and bad news bursts at once, it is on a plunge. Even among individual investors, there is a saying that “it is falling fast enough to give no chance to escape.”

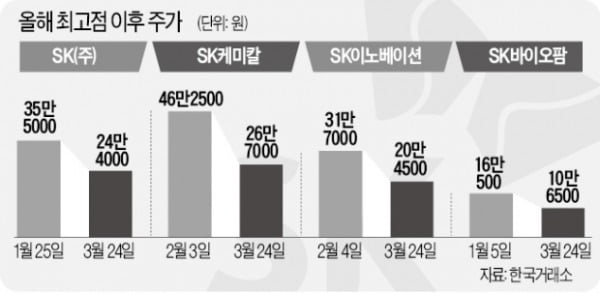

24th SK chemicals(267,000 -2.38%)Ended at 267,000 won, down 2.38%. Compared to this year’s highest point of 462,500 won (February 3), it is at the level of half. SK Biopharm(106,500 +1.43%)The stock price of Silver, which was 16,500 won at the beginning of the year, has dropped to 106,500 won. SK Innovation, which rose to 317,000 won last month(204,500 +1.24%)Fell to 204,500 won. SK D&D, attracting attention as a new and renewable energy stock(36,450 -0.14%)It also fell 25% compared to the beginning of the year.

SK, a holding company, was no exception. At the end of January this year, the stock price from 350,000 won fell to 244,000 won. SK Bioscience, recently listed(136,500 -2.85%)Ended at 136,500 won on that day. It fell close to 30% compared to the intraday peak (190,000 won). SK hynix supported the stock price of subsidiaries(133,500 -1.11%)It is also on the downtrend. In addition, SK Materials(309,000 +1.64%), SK Telecom(249,000 -0.60%), SK Discovery(59,800 +2.22%) The stock price of the back is also stagnant.

The reason for the decline in SK Group stocks is the result of overlapping market conditions and individual negatives. SK Chemicals has had a negative impact on the stock price of AstraZeneca’s COVID-19 vaccine stability issue, which has signed a contract for consignment production (CMO). SK Innovation was hit when Volkswagen declared’battery independence’. SK Innovation is known to have the highest VW order balance among the three battery makers.

The rise in interest rates has also deteriorated investment sentiment for growth stocks. Rechargeable batteries, bio, and hydrogen, which SK Group is focusing on, are representative industries belonging to growth stocks. There is also an analysis that the decline is greater as the stock price surged last year. It is said that it is suffering more this year as profits are realized around the stocks that have gone up. SK chemicals saw an increase of over 500% last year.

It is individuals who mainly bought SK Group stocks. This is the reason why people say that the fall is excessive. Individuals have bought SK Innovation for a net worth of KRW 1.2 trillion since the beginning of the year. During the same period, SK Biopharm bought KRW 1.55 trillion, SK KRW 2347 billion, and SK Chemicals worth KRW 122.4 billion. In addition, SK Hynix (1.34 trillion won) and SK Bioscience (228.6 billion won) were also bought.

The future outlook is not bad. SK Hynix is expected to record 1 trillion 2683 billion won in operating profit in the first quarter of this year thanks to the memory semiconductor’big cycle’. This is an increase of 58% compared to the same period last year. SK’s 1Q operating profit is projected to reach 84.7 billion won, up 192% year-on-year. However, it is analyzed that the stock price of key affiliates will be affected by the characteristics of the holding company.

SK Chemicals’ sales of the Corona 19 vaccine will be reflected from the first quarter. This year’s overall operating profit is 462 billion won, which is expected to increase by 294% compared to last year. The target price is KRW550,000, which is twice as high as the current share price. SK D&D’s operating profit is expected to grow only 10.3% this year to 111.2 billion won. However, it is expected that its value as a new and renewable company could stand out.

Reporter Park Uimyung [email protected]

Ⓒ Hankyung.com prohibits unauthorized reproduction and redistribution