Input 2021.03.14 10:24

There were also investors who paid the maximum amount available for subscription at other securities companies. Investors who received a maximum of 171 shares (170 proportional, 1 equal share) from Korea Investment & Securities and 195 shares (194 proportional, 1 equal share) from Mirae Asset Daewoo came out.

However, due to the excessive crowding of subscribers, some securities companies were unable to receive even one share with the minimum subscription alone. In Samsung Securities and Hana Financial Investment, where the allocation volume was small, 224,000 and 57,000 people, respectively, were found to have received less than one share.

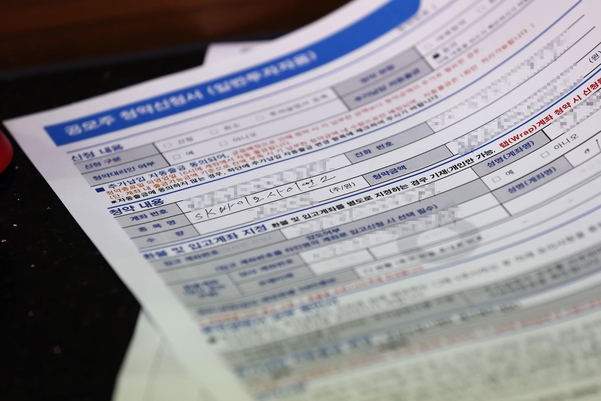

A total of 63,619.8 billion won in margin came into the subscription to SK Bioscience. Last year, it surpassed the scale of Kakao Games (58,554.3 billion won) and Big Hit Entertainment (58,423.7 billion won). A total of 239,8167 accounts from six securities companies participated in the subscription, resulting in an average subscription competition rate of 335 to 1.

Meanwhile, SK Bioscience will be listed on the 18th. On the day of listing, if the initial price starts at twice the public offering price (65,000 won) and jumps to the upper limit, so-called’tasang’ is recorded, investors will be able to make a profit of about 104,000 won per share.

At this time, the investor who received the maximum of 317 shares will earn about 33 million won. Investors who received 171 and 195 shares can earn 17.78 million won and 20.28 million won, respectively. If the ceiling price continues until the next day, the valuation gain per share will increase to 15,4700 won, and 317-week investors can earn more than 49 million won in two days.