Metropolitan apartment prices turn upward in 6 weeks… ‘6th week slowdown’ Seoul also shows signs of rebound

Weekly Market [한국부동산원 자료]

The Seoul metropolitan area and Seoul apartment prices, which showed a slowdown in the past few weeks due to the government’s 2·4 supply measures, rising mortgage loan interest rates, and soaring public prices, are showing signs of rebound. In particular, apartment prices in Siheung, Gyeonggi-do, where Korean Land and Housing Corporation (LH) employees were suspicious of prior land speculation, entered the 1% level, the only one in the country this week, showing a clear rise.

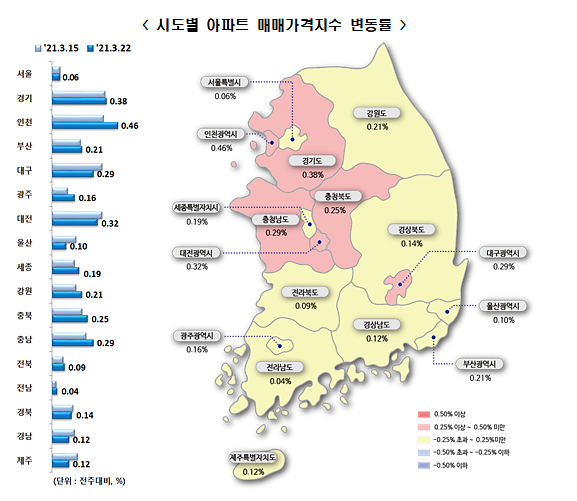

According to the Korea Real Estate Agency on the 25th, the nationwide weekly apartment sale price in the fourth week of March (as of the 22nd) was 0.24%, up 0.01%p from the previous week. The metropolitan area rose by 0.02%p to 0.29%, and Seoul recorded 0.06%, the same as in Jeonju.

The metropolitan area continued its highest growth rate of 0.33% in the fourth week of January to the second week of February, and then decreased the rate of increase for five weeks (0.30%→0.31%→0.29%→0.28%→0.27%). Turned around.

The game was up by 0.01%p from the previous week to 0.38%. In particular, Siheung City, the center of LH speculation suspicion, rose significantly from Jeonju (0.81%) to 1.09%, the only country in the country that entered the 1% level. It recorded the nation’s highest rate of increase due to expectations for transportation improvement. On the other hand, in Gwangmyeong, the ascent width decreased from 0.43% to 0.39%.

Ansan city (0.92%) is an area with undervalued perception or traffic concessions compared to the neighborhood, Uiwang city (0.89%) is in the morning, Poil and Naeson-dong, Bucheon city (0.54%) is in Okgil-dong, where traffic improvement is expected, and Gunpo-si (0.50%) is in Bugok. ·Dangjeong·Sanbon-dong increased mainly in mid-to-low prices.

Incheon led the rising trend in the metropolitan area, rising sharply to 0.46%, up from Jeonju (0.36%). Among them, Yeonsu-gu (0.85%), where Songdo International City is located, showed the highest rate of increase, mainly in Cheonghak, Yeonsu, and Dongchun-dong, which are expected to improve traffic such as the Walpan Line.

Following this, Jung-gu (0.54%) was in Yunnam and Jungsan-dong, where there are transportation benefits such as the 3rd Yeonryuk Bridge, Bupyeong-gu (0.45%) was in Bugae, Bupyeong, Samsan-dong, and Namdong-gu (0.43%) were on the GTX-B route and the second Gyeongin line. It has risen mainly in Seochang and Guwol-dong, where there is anticipation of improving the transportation environment.

Seoul, which had declined for the sixth consecutive week, stopped the decline with the same increase rate as last week. Seoul rose 0.10% in the first week of February, just before the announcement of the 2 and 4 measures, recording the highest rate this year, and then continued to slow for 6 consecutive weeks (0.09%→0.08%→0.08%→0.07%→0.07%→0.06%). did.

The Real Estate Agency analyzed that “Seoul has seen less inquiries on purchases due to expectations for supply measures, tax burdens, and concerns about interest rate hikes, but has maintained its rise last week as it has risen at mid-to-low prices in some regions.”

©’Five-language global economic newspaper’ Ajou Economy. Prohibition of unauthorized reproduction and redistribution