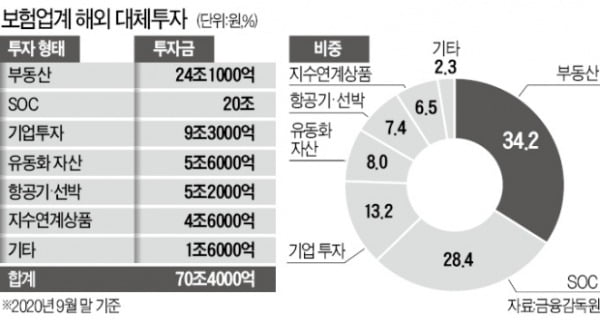

The Financial Supervisory Service checked the overseas alternative investments of insurance companies after the Corona 19 incident and found that assets with signs of insolvency amounted to 1.2 trillion won and decided to strengthen supervision. 300 billion won has already been exposed to a direct risk of loss. Alternative investment refers to investment in real estate, aircraft, ships, social overhead capital (SOC), in addition to stocks and bonds. The scale of insurance companies alone exceeds 70 trillion won.

○ Assets maturing this year alone is KRW 4 trillion

On the 22nd, the Financial Supervisory Service announced on the 22nd that it would prepare best standards for risk management within the first half of the year by unveiling’the current status of overseas alternative investment by insurance companies and the direction of future supervision. In the best practice, verification procedures will be specified, such as performing on-site due diligence or confirming the legal management relationship of collateral. Even if the price of the mortgage goods drops a little, the deliberation procedure for the’high mortgage recognition ratio (LTV) investment’ is also mandatory. An official from the Financial Supervisory Service said, “The maturity of 481 trillion won, which is 68.3% of the balance of the alternative investment, will come back after 2030, but the maturity of 4.4 trillion won will end this year.” “In the case of 2 trillion won invested in real estate such as hotels and offices, “There may be problems in the process of finding new tenants.”

According to the Financial Supervisory Service, the alternative investment assets of 36 insurance companies with overseas alternative investments are KRW 7 trillion. In the aftermath of the low interest rate, the bond market, which is the main investment destination, has contracted, and alternative investment has increased rapidly over the past two to three years. Although it is about 6.5% of the insurance industry’s total assets (1087 trillion won), even if an accident occurs in only one investment asset, it will have a big impact on individual companies.

The insurance industry recorded a double-digit increase in net profit last year as outdoor activities declined in the aftermath of Corona 19. However, Mirae Asset Life Insurance and KB Insurance’s operating profit declined, and Lotte Insurance’s losses again. This is the effect of losses as the business performance of hotels and airlines that have invested overseas plummeted.

○ There are also many middle and subordinated bonds

The Financial Supervisory Service counted the amount of assets that show signs of insolvent in overseas alternative investments or whose profitability is lower than planned at 1.2778 trillion won. Assets with a high risk of principal loss due to bankruptcy of borrowers who borrowed money or delays or suspension of construction, etc., reached 2721 billion won, and assets that were less profitable due to the adjustment of investment conditions that lowered interest rates or lowered the rent of buildings reached 1 trillion won. As of the end of September last year, the insurance industry estimates that the current situation is likely to get worse.

In general, domestic insurance companies often lend money to the middle or subordinate. It is difficult to properly recover money by selling collateral when a business fails, but the yield is high. An industry insider said, “If a senior lender says that they will go bankrupt and sell their collateral, Korean insurance companies are often asked for additional life-sustaining funds because Korean insurance companies can take their money.” “You can get money back or put more money. There is a possibility of falling into a countless dilemma.”

The Financial Supervisory Service is planning to guide insurance companies to ensure that they invest in the same place and evaluate their soundness and loss intensity differently, and to properly accumulate provisions. An official from the Financial Supervisory Service said, “If the insurer’s asset quality is poor, it can ultimately damage the insured.” “For insurance companies with a high proportion of alternative investments and weak internal controls, we will examine the health status every month.”

Reporter Park Jong-seo/Kim Dae-hoon [email protected]

Ⓒ Hankyung.com prohibits unauthorized reproduction and redistribution