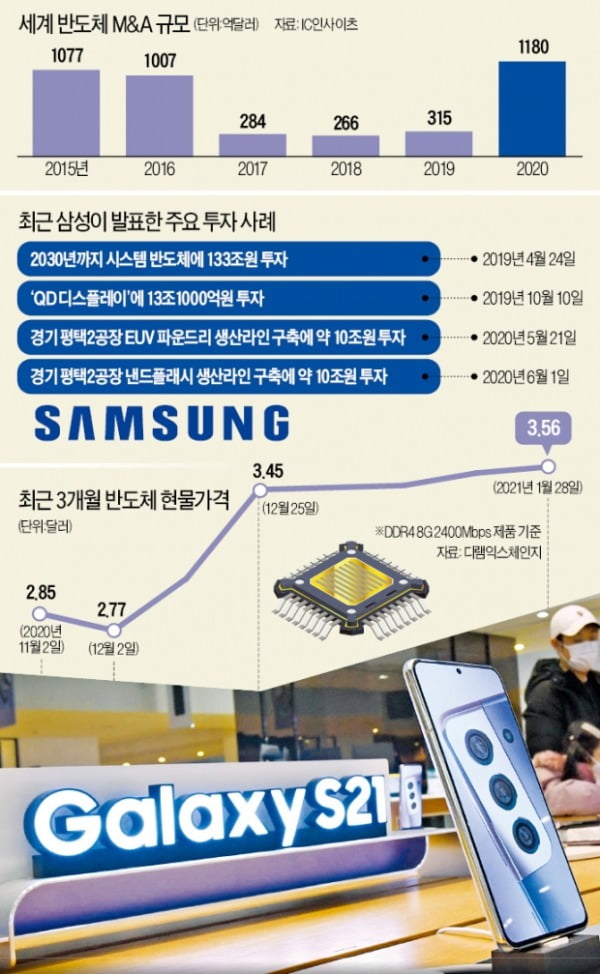

$118 billion (about 132 trillion won). This is the scale of mergers and acquisitions (M&A) between semiconductor companies last year. Samsung Electronics was not seen in the’money games’ of global semiconductor companies such as Nvidia, AMD, and SK Hynix. The net cash holdings of 104 trillion won and the world’s second largest semiconductor sales were a prudent move that did not suit the appearance.

It is expected to be different in the future. In a conference call held on the 28th, Choi Yun-ho, head of Samsung Electronics’ management support department (president, CFO) said, “We will strengthen our market-leading position in existing businesses and strengthen the foundation for sustainable growth in new businesses.” “We will expand M&A within 3 years.” It is predicted that Samsung Electronics will bet a large amount on vehicle system semiconductor companies sooner or later.

Consistently preparing for M&A

Since Samsung Electronics acquired Haman, an automotive electronics (electronic equipment) company, for $8 billion in November 2016, there is no significant M&A record so far. Most of them took over startups with excellent technology such as Core Photonics. Under the water, a large-scale M&A was prepared, but due to the influence of judicial risk, it could not be put on the surface. President Choi explained, “I kept reviewing the M&A and prepared a lot.”

The official remarks on the M&A are interpreted by the influence of Samsung Electronics Vice Chairman Lee Jae-yong’s message. On the 26th, Vice Chairman Lee emphasized, “Samsung must continue to follow the path it should go,” and “must be faithful to the corporate duty of investment and job creation.” He asked them to focus on their work without a gap in the total number.

In the market, the observation that Samsung Electronics will engage in M&A for vehicle system semiconductors and electronic equipment companies is predominant. The major candidates are NXP and Infineon, a European automotive semiconductor company, where the M&A rumor has circulated in 2019. Kang In-yeop, the head of the system LSI business division (president), was asked about NXP at a business briefing in June 2019, and said, “I will not discuss a specific company, but the possibility of a large M&A is open.

“Memory semiconductor prices will rise”

It was President Choi’s remarks of’expanding strategic facility investment’ that received attention in the market along with the M&A on this day. It is analyzed that the plan was to expand the Austin foundry (semiconductor consignment production) plant in the US. US media such as the Wall Street Journal (WSJ) recently reported that “Samsung Electronics will spend up to 17 billion dollars to build the latest foundry line in the US mainland.”

Samsung Electronics acknowledged the need for expansion, but avoided that it had not been decided. On the day, Seung-Hoon Han, executive director of the foundry division’s marketing team, said, “There is no decision to invest in the US,” he said. Regarding Memory Semiconductor’s facility investment plan for this year, Samsung Electronics also gave a fundamental answer, saying, “It will meet market demand.”

It presented a positive outlook on the market conditions. This is because the demand for server, mobile DRAM and NAND flash will recover. Han Jin-man, vice president of memory business division, said, “It seems that the inventory adjustment of server DRAM customers has been completed, and mid- and low-priced 5G smartphones are also increasing,” and said, “The DRAM industry is expected to improve in the first half.” However, for the same supercycle (long-term boom) from 2017 to 2018, he explained, “Because of risk factors such as geopolitical risks, we must take a cautious position.”

In addition, the System LSI Division emphasized that it will record double-digit sales growth this year by expanding sales of 5G integrated chipsets, image sensors, and display driving chips. The Foundry Division indicated that it would expand orders for high-performance computing (HPC) chips and 5G chipsets.

Bespoke expands Neo QLED sales

Regarding the smartphone business, both the 1Q and annual market forecasts were optimistic. The demand for next-generation smartphones is expected to increase due to the expansion of 5G infrastructure in each country, and both sales and profits are expected to increase due to the launch of flagship models such as the Galaxy S21 and low-end models. It is planning to increase the consumer base of high value-added products and increase sales by releasing new form factor (external features) models such as rollables and slideables.

In the consumer electronics (CE) sector, which saw the non-face-to-face economic effect last year, it is predicted that a’flower road’ will be laid this year. Samsung Electronics plans to reinforce its growth and profitability, focusing on next-generation products such as’Neo QLED’ and micro LED TV, which were recently unveiled. In household appliances, it is planning to expand the product line of’Bespoke’, which succeeded in being popular last year, and increase the number of countries released.

Reporter Hwang Jung-soo/Lee Soo-bin [email protected]