[팩트체크] Short selling of hot issue stocks, can’t’ant’?

Resumption of temporarily banned short selling Inaccurate arguments amid disputes

Individuals can’t even sell short?… Individuals are also possible, but conditions are more disadvantageous than institutions

Can short selling without borrowing?… Banned by law, but the punishment is weak and detection is difficult.

(Seoul = Yonhap News) Reporter Soon-Hyun Lim = Last year’s new coronavirus infection (Corona 19) in the early stages of the market unrest to prevent the spread of’short selling ban’ is expected to end on March 15, while some say’Resumption of short selling’ There is a voice saying that short selling should be abolished altogether, saying,’It is unilaterally disadvantageous only for individual investors.’

The Financial Services Commission announced on the 11th that the ban on temporary short selling due to Corona 19 is scheduled to end on March 15 through a notice to the access reporters. If there is no separate policy decision on the ban on short selling, short selling will resume from March 15 as scheduled.

As short selling resumes become visible, individual investors who are concerned about a share price decline are actively opposing short selling. There are many experts saying that it is necessary to resume short selling as a’control device’ that removes the’bubble’ from the stock market, but there is high opinion among so-called’Donghak ants’ against short selling.

As of 2 pm on the 13th, 107,000,737 people agreed to the petition for the’permanent ban on short sale’ posted on the Blue House National Petition bulletin board.

On-line, there are reactions saying, “If short selling allowed only for institutions resumes, only individual investors will suffer damage” or “Institutional investors will earn unfair profits by short selling without borrowing that they do not actually borrow stocks.”

◇ “Individuals can’t even sell short?”… Individuals and short sales are also possible, but conditions that are more disadvantageous than institutions

First of all, the argument that’short selling is allowed only to institutional investors and only individual investors suffers’ is not strictly true.

Short selling is an investment method in which stocks you do not own are borrowed and sold, and then the borrowed stock is bought back and paid off. If the stock price rises after selling, the company loses the difference by the difference, and conversely, if the stock price falls, it makes a profit.

For example, when Company A’s stock is 10,000 won, it is borrowed and sold, and when the stock price is more than 10,000 won, it is bought again and paid back.

If short selling is allowed only by institutions, individual investors generally have no way of avoiding losses during stock price declines.

However, there are no regulations restricting short selling by individual investors in related laws such as the’Capital Markets and Financial Investment Business Act’ (Capital Markets Act). As long as stocks can be borrowed, even individual investors can sell short.

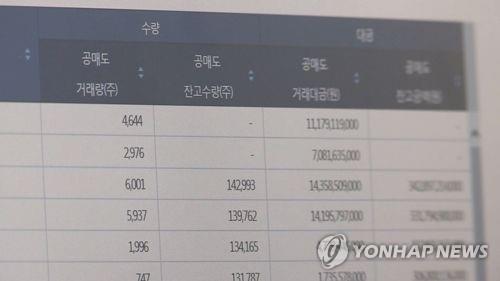

According to the Korea Exchange, the average daily trading value of individual investors in 2016 was about 3.5 billion won in the securities market (KOSPI) and about 2.4 billion won in the KOSDAQ market. In addition, in 2016 alone, the number of individual investors who sold short had about 6,400 accounts. Short selling by individual investors took place.

The reason short selling is allowed to both institutional and individual investors without restriction can be seen because short selling itself has a net function, such as helping to prevent’overvaluation’ of stock prices.

Theoretically, the price of a stock is a balance between a buy tax that evaluates the market value of the stock with a high value and a sell tax that evaluates the market value of the stock. . In such a case, the short selling system, which allows investors who underestimate the market value of the stocks to sell stocks without holding stocks, helps to reduce the’bubble’ in the market caused by overvaluation of stocks.

However, it cannot be overlooked that short selling by individual and institutional investors is not conducted under equal conditions. In other words, it is different from the fact that individuals cannot sell short, but it is a fact that individuals are at a disadvantage compared to institutional investors in terms of short selling conditions.

Short selling is divided into’loan transaction’ in which securities companies lend stocks to institutional investors and’loan transaction’, which is lent to individual investors.

Loan transactions operated by KFTC have a rental period of 6 months to 1 year, whereas loan transactions with loans are only 30 to 90 days. In addition, lending transactions are 1-4% of fees, but lending transactions are usually 5% or more.

Institutional investors can earn profits by holding the borrowed stocks for up to one year on the condition that they pay a fee of 1 to 4%, waiting for the stock price to decline, and then selling them shortly.Individual investors pay a relatively high fee and purchase the borrowed stocks for up to three months. It can be said that the conditions are disadvantageous compared to institutional investors because they have to sell and pay back.

“Individual investors can sell short, but due to unfavorable conditions, the actual transaction volume is insignificant compared to institutional investors,” said Ahn Jin-geol, director of the Institute for Public Economics, on the 13th. We have to come up with measures to reduce it,” he said.

◇ “If short selling is resumed, non-borrowing short selling is allowed?”… The law is forbidden, but punishment is weak and detection is difficult.

Opponents of short selling are also concerned that’if short selling resumes, institutional investors will be able to earn unreasonable profits by enabling non-borrowing short selling.’

Short selling without borrowing refers to short selling without lending stocks in advance. It’s a kind of credit transaction in which you sell once and later lend stock.

In practice, it is done by verbally promising to lend stock, and then putting stock in the account and selling based on this. It is a short sale with only the evidence that stocks can be borrowed.

First of all, such non-borrowing short selling was prohibited under the Capital Markets Act revised in June 2000.

Article 180 of the Capital Markets Act prohibits all short selling except for’short selling using previously borrowed stocks’ (borrowing short selling). Any short selling other than’borrowing short selling’, which is sold after actually borrowing stocks, is considered illegal.

In addition, pursuant to Articles 426 and 427 of the Capital Markets Act, the Securities and Futures Commission may investigate, confiscate, or search the suspect if there is a suspicion of illegal short selling, such as non-borrowing short selling.

However, it is pointed out that the’prevention’ effect through severe punishment is difficult because it is difficult to say that the punishment for the short sale without borrowing is strong in reality.

According to Article 443 of the Capital Markets Act, which is a punishment rule for non-borrowing short selling, it is subject to punishment by imprisonment for more than one year or a fine of 3 to 5 times the illegal profit.

In general, if the illegal profits obtained in violation of the Capital Markets Act are less than 500 million to 5 billion won, they will be punished with more than 3 years imprisonment, and those over 5 billion will be punished with life imprisonment or 5 years or more. Excluded.

Criminal punishment is also possible only when it is proved that the short sale was intentionally made without borrowing, so in most cases, it is limited to fines or fines for negligence.

In addition, as described above, since non-borrowing short selling is made while stocks are in stock temporarily, it is difficult to detect only the appearance of stock trading. This is because short selling without borrowing can be done by disguised as a normal stock transaction.

Another problem is that the length of non-borrowing short selling is not’blocked out’ in the stock trading system of domestic securities companies. Most securities companies’ stock trading systems allow institutional investors to choose between’general selling’,’borrowing short selling’, and’other short selling’ when selling stocks, and many point out that non-borrowing short selling is made using these other short selling.

This is because there is a procedure to check whether stocks are actually held in general selling and whether there is actually borrowed stocks in borrowed short selling, but other short selling does not.

In conclusion, short selling without borrowing is legally prohibited, but the level of punishment is weak and it is difficult to detect it in practice, so there is inevitably a high concern about its popularity.

<<연합뉴스 팩트체크팀은 팩트체크 소재에 대한 독자들의 제안을 받고 있습니다. 이메일([email protected])로 제안해 주시면 됩니다.>>

[email protected]

(End)

<저작권자(c) 연합뉴스, 무단 전재-재배포 금지>

Copyrightⓒ Korea Economic Daily TV. All Rights Reserved. Unauthorized reproduction and redistribution prohibited