A, a foreigner, is more satisfied with living in Korea because of the spread of the novel coronavirus infection (Corona 19). Compared to other countries, quarantine is well established, and the level of welfare systems such as medical care is also high. He has brought in foreign funds worth tens of billions of dollars to Korea and is living a luxurious life, such as shopping for medical care with his family.

However, when Mr. A pays taxes, he advocates that he is a foreigner. If it is classified as a non-resident foreigner, it uses the point of not paying domestic income tax. For this reason, he often deliberately left the country and manipulated the number of days of stay.

Initiated a tax investigation for 54 offshore tax evasioners by the National Tax Service

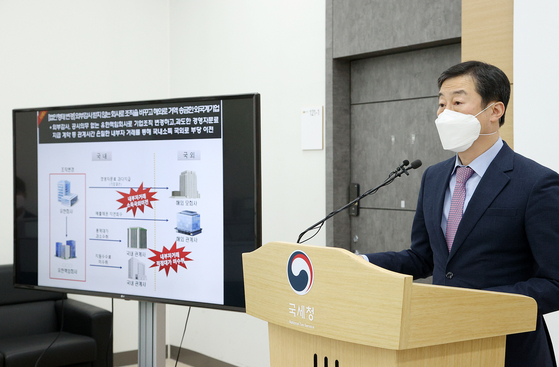

On the 24th, the National Tax Service announced that it had initiated a tax investigation on 54 suspects of intelligent offshore tax evasion, including nationality laundering, with a briefing. revenue

While living in Korea and enjoying welfare benefits such as medical care, when paying taxes, people who were deceived as if they were overseas residents were caught. The National Tax Service announced on the 24th that it has initiated a tax investigation after confirming 54 people who are suspected of laundering their nationality, etc., or tax evasion outside the country using international transactions.

Under the domestic income tax law, even if a foreigner or dual citizen has stayed in Korea for more than 183 days, which is half of a year, or has actually been living in the country, it is considered as a resident. If classified as a resident, income earned abroad must also be taxed in accordance with domestic law.

However, as in the case of Mr. A, 14 out of 54 people caught this time disguised themselves as non-residents who were not obligated to pay taxes, concealing their income and property abroad and avoiding taxes.

Mr. B, who is a dual citizen, lives in Korea with his family and acquires real estate worth 10 billion won and even rents. However, he pretended to be a dual citizen and pretended to be a non-resident, omitting taxes on foreign income.

Koreans are also tax evasion for reasons of staying abroad

Although Korean, there are also people who are accused of evading taxes by pretending to not live in Korea. Even if they are not foreigners or dual citizens, if they are recognized as non-residents, they are not subject to domestic tax laws on overseas income.

C, who actually rents a real estate worth 20 billion won, lives in Korea with his family, but disguises himself as a non-resident because he has a lot of foreign access. In the process, he omitted the report of foreign income and was listed on the tax audit list at the National Tax Service.

In addition to’identity laundering’, a number of cases have been found to take property overseas by using a corporation.

The National Tax Service launched a tax investigation on 54 offshore tax evasion suspects who laundered their identities or used a corporation to evade taxes. The photo is a paper company suspected of using it for offshore tax evasion. revenue

Mr. D, who operates a corporation in Korea, has created a subsidiary that he owns 100% in overseas tax havens. Then, the core intangible assets of the domestic subsidiary were deprived of the subsidiary. In exchange for using this intangible asset, a domestic corporation paid a large amount of usage fees to its subsidiaries. Mr. D used this subsidiary to pay salaries to his children studying abroad. The company also transferred its stake and promoted the succession of management rights.

‘Black-haired foreigners’ who promoted citizenship also tax evasion

Offshore tax evasion for the purpose of evading or donating taxes, even if it is not in the corona 19 situation, has been used as a tax evasion method “that people who know know”. In the past investigation by the National Tax Service, most of them live in Korea, but there were also so-called’black-haired foreigners’ who avoid taxes by using foreign citizenship.

An example of not paying real estate gift tax due to foreign citizenship. revenue

Mr. E, who lives in Korea, bought overseas real estate under the name of Paper Company, and then gave the gift by transferring the corporate stake to the child. E and his children were residents of Korea and had to pay gift tax, but they pretended to be foreign citizens, pretending to be non-residents and omit the gift tax.

There was also the owner of a medical company that did not pay the transfer tax even after paying a’jackpot’ by investing in overseas real estate. They set up a Family Trust, where profits go to their families, and concealed the proceeds from the sale of real estate.

As a result of the investigation of 318 offshore tax evasion and multinational corporation tax evaders three times since 2019 by the National Tax Service, only the tax collected was KRW 1,162.7 trillion. Five of these were filed with the prosecutor’s office on charges of evading taxation.

Investigation Bureau Chief Roh Jeong-seok said, “As this investigation targets anti-social offshore tax evasion charges that use the national crisis for personal savings and use superior economic status and expertise for tax evasion, we will thoroughly verify the charges of tax evasion.”

Sejong = Reporter Kim Namjun [email protected]

![]()