Thanks to the increase in interest income and securities fees… Reflected losses of 472.5 billion won including Lime Fund

It is 40.6 billion less than KB Finance… Reversed after 3 years

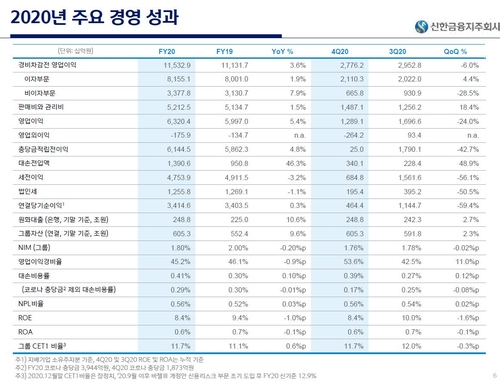

(Seoul = Yonhap News) Reporter Shin Shin-kyung = Shinhan Financial Group made the largest profit ever, exceeding 3.4 trillion won last year, as loans and stock investment increased in the aftermath of the novel coronavirus infection (Corona 19).

However, it was about 40 billion won less than the previously disclosed KB Financial Group’s annual net income (3.455 trillion won), giving it the No. 1 position in financial holdings after three years. In the end, losses related to the private equity crisis, such as the Lime Fund, which were close to 500 billion won, caught up.

Shinhan Financial Group announced on the 5th that last year’s net profit (based on the net profit of the controlling company’s equity) was totaled at 3,4146 billion won. This is the largest since the establishment of the holding company, 0.3% more than in 2019 (3.4 trillion won).

An official of Shinhan Financial Group said, “Group interest income increased 1.9% due to solid asset growth in the banking sector, and securities commissions increased by 125% from the previous year due to the increase in stock trading volume in the second half of the year, and group non-interest income also increased by 7.9%.” Even in the internal and external business environment, net profit continued to increase for 7 consecutive years,” he explained.

The group’s total assets as of the end of last year (836 trillion KRW) also increased by 9.3% (71 trillion KRW) from the end of 2019 (765 trillion KRW) due to the influence of the increase in loan receivables.

In order to preemptively respond to the Corona 19 hit, Shinhan Financial Group’s provision for bad debts accumulated last year totaled 1.3906 trillion won, up 46.3% from the previous year (950 billion won). In the 2020 performance, a total loss of investment products such as Lime Fund was 472.5 billion won.

[신한금융지주 제공.재판매 및 DB 금지]

By affiliate, Shinhan Bank’s net profit fell 10.8% year-on-year to KRW 2.78 trillion. Net interest income increased by 1% from 6.75 trillion won to 6.79968 billion won, but the amount of provision for bad debts surged 93.6% from 3513 billion won to 6802 billion won.

Shinhan Card’s net profit for the year was 66.5 billion won, an increase of 19.2% (97 billion won).

However, Shinhan Investment Corp’s net profit (154.8 billion won) has decreased by 29.9% (661 billion won) in a year. Thanks to active stock trading, commission income (740.4 billion won) increased by 45.6%, but due to losses related to the Lime Fund, bad debt expenses, which were almost absent last year, amounted to KRW 155.8 billion.

Looking at the results of the fourth quarter of last year alone, KB Financial Group’s overall net profit was KRW 464.4 billion, down 8.5% from the fourth quarter of 2019 (KRW 57.5 billion). Compared to the previous 3rd quarter (1,144.7 billion won), it is 59.4% less.

A Shinhan Financial Group official said, “In the fourth quarter, Shinhan Bank reflected losses of 69.2 billion won related to Lime CI Fund, and losses related to Lime TRS (Total Revenue Swap) at Shinhan Investment Corp. were reflected. The related provision was also accrued an additional KRW 187.3 billion,” he said. “Here, the desired retirement cost was added up to 92.4 billion won. Excluding one-off expenses, the fourth quarter’s ordinary income was about 900 billion won, 28% higher than the same period last year.” did.

Earlier last month, the financial authorities recommended’dividend payout ratio within 20%’ to financial holding companies, and Shinhan Financial Group confirmed the dividend payout ratio (shareholder’s dividend ratio among current net income) and dividend per share at the board of directors held prior to the announcement of the results. I pushed back without doing it.

In the conference call after the announcement of the performance, questions from domestic and foreign institutional investors focused on the’dividend policy’.

Roh Yong-hoon, vice president of Shinhan Financial Group (CFO), predicted, “We will hold the board of directors until early March to decide whether to accept the recommendations of the supervisory authorities or consider other factors.”

He said, “Because the supervisory authority’s guidelines (guidelines) have been stress-tested on financial institutions, it seems difficult to challenge (appeal),” he said. “We respect the supervisory authority’s recommendations, but each financial institution finds reasonable reasons and I think we can prove the dividend level and persuade it. I will try to find a reasonable reason and discuss it.”

In addition, Vice President Roh said, “We plan to increase our dividend payout ratio to 30% (in the mid- to long-term), and in the case of quarterly dividends, we will prepare for changes in the articles of incorporation in the first half of the year so that it can be executed in the second half.” “We plan to implement a shareholder return policy from the second half of the year, even through it.”

[연합뉴스TV 제공]

Unauthorized reproduction-redistribution prohibited>

2021/02/05 17:11 sent