Enter 2021-03-25 14:00 | Revision 2021-03-25 14:03

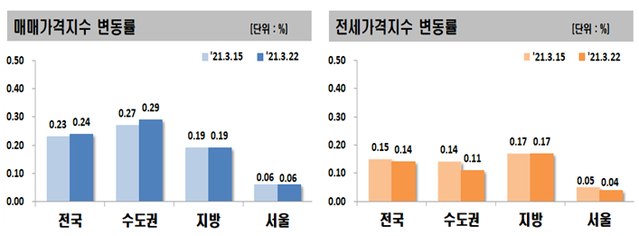

▲ The rate of change in the trading and jeonse price index in major regions in the 4th week of June.ⓒ Korea Real Estate Agency

The rise in apartment prices in Seoul has slowed as the government’s measures to supply 2 and 4 housing units, rising mortgage loan interest rates, and a surge in publicly announced prices were added. The jeonse price has also risen to the lowest level since June of last year, ending a sharp rise and calming down. In the market, sales of tens of millions of won lower than the market price are coming out one after another, and there is a prospect that the Seoul house price has entered an adjustment phase.

According to the Korea Real Estate Agency’s weekly apartment price trend on the 26th, the nationwide apartment sale price as of the 22nd rose 0.24%, slightly higher than last week’s 0.23%.

The main effect was that apartment prices in the metropolitan area rose from 0.27% last week to 0.29% this week. However, Seoul recorded an increase of 0.06%, the same as last week, and the provinces also increased 0.19%, the same as last week.

Seoul rose 0.10% in the first week of February, just before the announcement of the second and fourth countermeasures, and recorded the highest increase this year for the seventh consecutive week (0.09%→0.08%→0.08%→0.07%→0.07%→0.06%→0.06%) It seems to be slowing down.

An official at the Real Estate Agency explained, “Seoul is showing a decrease in purchase inquiries due to concerns about supply countermeasures, increased tax burdens, and interest rate hikes,” and “in some regions, the rise was maintained last week by rising centered on mid-to-low prices.” .

By distinction, Yangcheon-gu rose 0.11% for 5 consecutive weeks, with the highest increase rate in Seoul. Songpa (0.08%), Seocho (0.07%), Gangnam (0.07%), and Gangnam 3 districts, as well as Nowon-gu (0.09%) and Dongjak-gu (0.07%) exceeded the average.

In Gyeonggi (0.37% → 0.38%), the rising trend of areas with expectations for traffic improvement, such as the GTX line, is continuing. In anticipation of improvement in settlement conditions following the 3rd new city development, Siheung City continued a high rate of increase from 0.81% last week to 1.09% this week.

Fat gained 0.19% for 4 consecutive weeks and moved sideways. The five major metropolitan cities in the region increased 0.23%, reducing the width of the peak from Jeonju (0.24%). However, Sejong City increased 0.19% this week from 0.16% last week, increasing the increase.

The jeonse, which has risen to a high level, is also calming. The nationwide apartment rental price decreased from 0.15% last week to 0.14% this week.

In particular, the rate of increase in Seoul decreased from 0.05% to 0.04%, the lowest level in nine months since the first week of last June (0.04%).

Some analysts analyzed that the rise in house prices and jeonse prices slowed as housing transactions declined due to the effects of the government’s 2nd and 4th measures, increased holding tax burden due to the realization of published prices, and increased fatigue due to a surge in house prices. Is coming out.

Buying sentiment also dampened as fatigue caused by soaring house prices and the movement of interest rate hikes were combined. According to KB Kookmin Bank’s Liveon, the housing purchase advantage index in Seoul as of the 15th was 82.4, down 7.9p from the previous week. It is the lowest since early November of last year.

An industry expert said, “It is not easy for the house price to turn to a decline in a short period of time, as the pipe net tax increased due to complex factors such as fatigue caused by a surge in house prices, increased burden on ownership tax, and increased interest rates on mortgage loans. “He said.

Press releases and article reports [email protected]

[자유민주·시장경제의 파수꾼 – 뉴데일리 newdaily.co.kr]

Copyrights ⓒ 2005 New Daily News-Unauthorized reproduction, redistribution prohibited

recommendation

Related Articles It’s good to read it with the article you just saw!

Vivid

Headline news Meet with the main news at this time.