With the government designating 37 locations across the country as additional regulated areas last week, the sale price of apartments in Seoul is running high.

In particular, apartment prices in Gangnam 3-gu, which had been showing a calming pattern for a while, gradually increased and rose the most in five months.

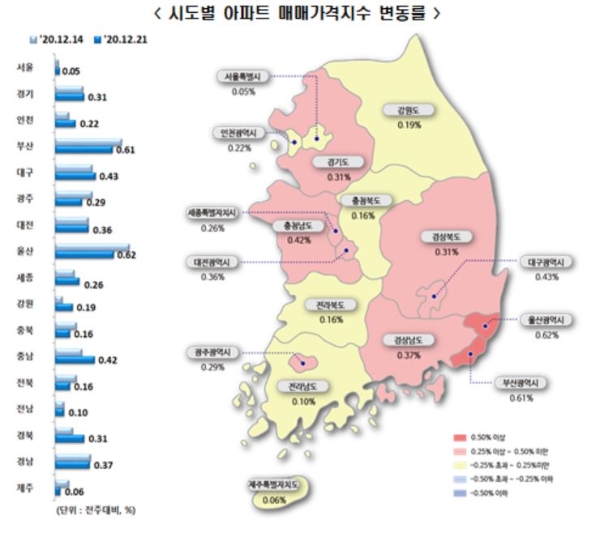

According to the’weekly apartment price trend for the third week of December’ released by the Korea Real Estate Agency on the 24th, the sale price of apartments in Seoul rose by 0.05%, up from last week (0.04%). It is the largest increase since it rose 0.06% in the 3rd week of July.

Seoul’s 25 districts are ▲Songpa-gu (0.10%) ▲ Seocho-gu (0.09%) ▲ Mapo-gu (0.08%) ▲ Gangnam-gu (0.08%) ▲ Gwangjin-gu (0.07%) ▲ Gangdong-gu (0.07%) ▲ Dongdaemun-gu (0.05%) ▲ Nowon-gu ( 0.05%) ▲ Jongno-gu (0.04%) ▲ Seongbuk-gu (0.04%) ▲ Gangbuk-gu (0.04%) ▲ Yangcheon-gu (0.04%) ▲ Dongjak-gu (0.04%) ▲ Gwanak-gu (0.04%) ▲ Jung-gu (0.03%) ▲ Yongsan-gu (0.03%) ) ▲ Jungnang-gu (0.03%) ▲ Dobong-gu (0.03%) ▲ Eunpyeong-gu (0.03%) ▲ Gangseo-gu (0.03%) ▲ Seongdong-gu (0.02%) ▲ Seodaemun-gu (0.02%) ▲ Guro-gu (0.02%) ▲ Geumcheon-gu (0.02%) ▲ It rose in all regions, including Yeongdeungpo-gu (0.02%).

The rate of increase in apartment prices in the three districts of Gangnam also peaked in five months. Songpa-gu led to complexes with anticipation of reconstruction such as Garak, Jamsil, and Bangi-dong, and Wirye New Town, while Seocho-gu led to mid-range complexes such as Bangbae and Seocho-dong.

In particular, in Apgujeong-dong, Gangnam-gu, apartment prices have risen sharply as the pace of the recent reconstruction project has accelerated. Apgujeong-dong New Hyundai 11th 183.41㎡ was traded at a reported price of 4.9 billion won (10th floor) on the 15th, and 260 million won from the previous reported price of 4.64 billion won (13th floor) in October. The 116.94㎡ of Hanyang 3rd was traded at a reported price of 2.8 billion won (8th floor) in August after the transaction at a reported price of 2.9 billion won (10th floor) on the 20th.

In the Gangbuk area, Mapo-gu has increased in popularity with Ahyeon-dong popular complexes, Gwangjin-gu has mainly been raised with a plaza and Guui-dong large complex with good living conditions, and Nowon-gu has been driven by complexes with anticipation of progress in maintenance projects.

An official at the Real Estate Agency explained, “Amid the continued impact of low interest rates and liquidity expansion and decreased occupancy volume, the buying trend has increased mainly in areas where maintenance projects are being promoted and relatively low and mid-priced complexes.”

Experts in the real estate market diagnose that the government’s simultaneous measures to expand regulated areas have fueled this atmosphere of rising housing prices in Seoul.

It is explained that on the 17th, the government grouped 37 regions across the country into regulated regions, such as those subject to adjustment, and investment sentiment brought about the’inverted balloon effect’ of moving back to the Seoul region, where prices have high potential.

An official from the real estate industry said, “As most of the country is tied to a regulated area, there is a growing awareness that it is better to purchase an apartment in the Seoul area if it is subject to similar regulations anyway.” “The’one smart house’ of consumers in areas with high residential preferences The preference phenomenon will continue next year.”

Kim Ha-soo, Global Economic Reporter [email protected]