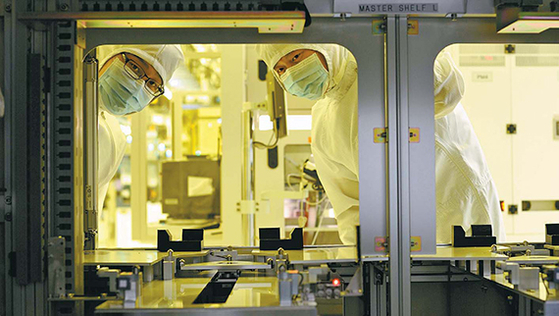

![SK Hynix announced last year's performance, which was improved compared to the previous year on the 29th, with high expectations for the semiconductor super cycle despite the Corona 19 crisis. The picture is inside SK Hynix's Icheon semiconductor plant in Gyeonggi-do. [사진 SK하이닉스]](https://i0.wp.com/pds.joins.com/news/component/joongang_sunday/202101/30/5e5befb9-957f-4fd5-8864-65d75ae0e172.jpg?w=560&ssl=1)

SK Hynix announced last year’s performance, which was improved compared to the previous year on the 29th, with high expectations for the semiconductor super cycle despite the Corona 19 crisis. The picture is inside SK Hynix’s Icheon semiconductor plant in Gyeonggi-do. [사진 SK하이닉스]

From the beginning of the new year, the world’s’semiconductor war’ is on fire. Taiwan’s TSMC, the world’s No. 1 foundry market, is winning and winning. This is because Intel and Qualcomm drove production to TSMC, the US’semiconductor alliance’. The US is enjoying reflective profits as the US banned the export of advanced semiconductor equipment and technology to SMIC, China’s largest foundry last year. A foreign press reports that Samsung Electronics, whose main focus is on memory semiconductors, is also considering new and expanded factories in Austin, USA to keep up with the ranks. On the contrary, Qualcomm, a leader in semiconductor design, is struggling as exports to China are blocked.

US-led semiconductor alliance strengthens

Taiwan TSMC gains reflection profit

Samsung Electronics also expands and expands to close the gap

This new aspect of the semiconductor market originated from the war for supremacy between the US and China. The essence of the US-China conflict is the next-generation technology war in the era of the 4th industrial revolution, and the current battlefield is semiconductors. The US, which crushed the Japanese semiconductor industry in the 1980s, is continuing sanctions to cut off the sprout of China’s’semiconductor rollout’, which will be a future threat. This pressure is not expected to change in the Biden administration. “Semiconductors are the backbone of the 4th Industrial Revolution,” said Lee Jong-ho, head of Seoul National University’s Semiconductor Research Institute.

TSMC’s solo performance is not nice to Korea either. TSMC surpassed Samsung Electronics (18.81 trillion won) for the first time with an operating profit of 22.4 trillion won last year. Samsung Electronics plans to make large-scale investments, such as new or expanded factories or mergers and acquisitions (M&A), to close the gap with TSMC. In a performance announcement on the 28th, Yoon-ho Choi, head of Samsung Electronics’ management support office, said, “We plan to further solidify our market leadership position in the existing industry through large-scale investments.”

We need to prepare for when China’s pursuit, which has been slowed by the US offensive, resumes someday. Park Jae-geun, a professor at the Department of Convergence Electronics Engineering at Hanyang University, said, “Even if China rushes again, there is a lot of difference in technology, so it is difficult to pursue the gap.” You have to apply.”

Reporter Hwang Jung-il [email protected]