DS Investment & Securities on the 3rd Seegene(172,700 -3.90%)On the other hand, it suggested that earnings growth would be possible this year as well, and presented an investment recommendation of’Buy’ and a target price of 254,000 won.

Researcher Seung-Hui Kim said, “The share price of Seegen has declined by 35% over the past three months due to concerns about the decline in demand for diagnostic kits as the supply of the Corona 19 vaccine becomes visible.” .

From October to December last year, the export of diagnostic kits located in Songpa-gu, Seoul, was $ 357.21 million, an increase of 64.7% from the previous quarter. Accordingly, Seegene’s sales in the fourth quarter of last year are expected to increase by 1429.6% year-on-year to 4803 billion won, and operating profit to increase by 6011% to 313.4 billion won.

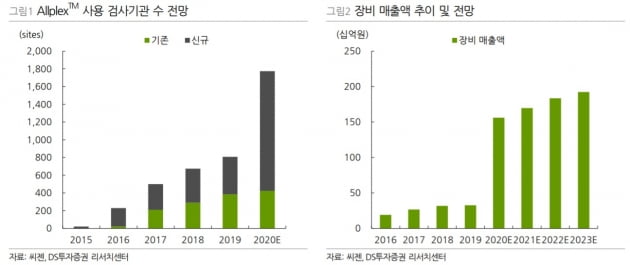

Earnings growth is expected to continue in 2021 due to an increase in global testing agencies amid the expansion of equipment supply and demand for diagnosis of mutant viruses. This year’s sales increased 12.0% year-on-year to KRW 1,302.8 billion, and operating profit increased by 11.6% to KRW 8167 billion.

Researcher Kim said, “The basis of sales growth is the expansion of the spread of equipment that can use All-Flex diagnostic kits.” You can expect sales.”

Rich cash is also expected to contribute to the increase in corporate value. In the next year, it is expected that more than 1 trillion won in cash can be held, which will enable entry into new businesses, mergers and acquisitions, and strengthened shareholder return policies.

Reporter Minsoo Han [email protected]

Ⓒ Hankyung.com prohibits unauthorized reproduction and redistribution